This article briefly reviews my portfolio performance in Q4 and 2024 and the positions I plan to hold into 2025. I also revised the sectors and ideas I covered in the blog to see if the fundamental outlook has changed significantly.

Expect one such article at the end of every quarter.

Before beginning, I wanted to thank all of Quipus Capital readers for a great 2024. The blog grew from literally no readers to 700 subscribers and followers across platforms. Writing and researching for Quipus is a great pleasure.

Portfolio, returns, and changes in Q4

This article does not contain my Argentinian portfolio, and only the IBKR portfolio. The reason is that doing the calculations for returns is not very easy for the Argentinian portfolio, so I will keep at half-year reviews. Suffice it to say that the portfolio (about 1/2 the size of the IBKR portfolio below) owns three securities: EEM, BSBR, and Lojas Renner (no US ticker). EEM was down 11% in the quarter, BSBR something like 30%, and Lojas Renner 25%. So it was not a good quarter at all.

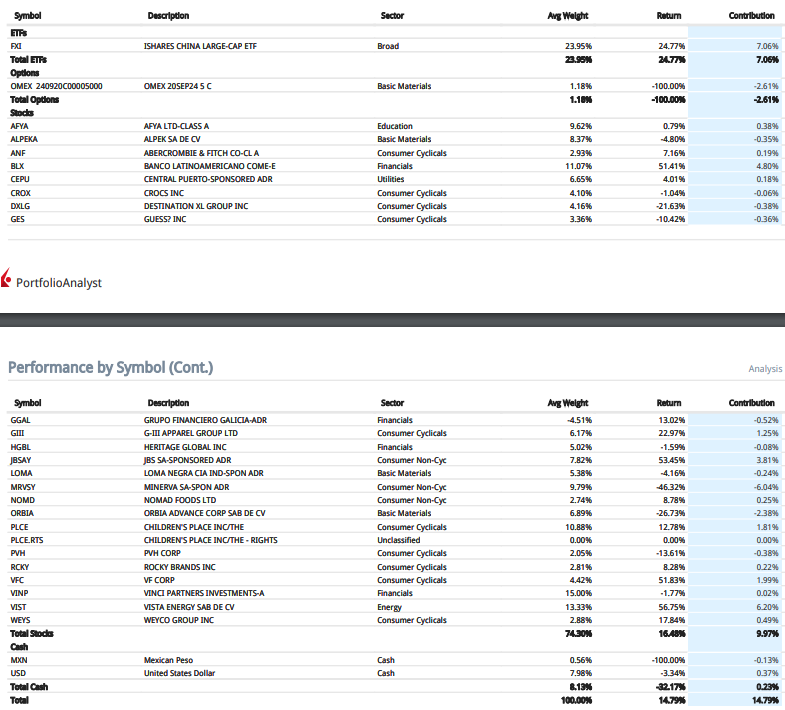

FY24

FY24 return: 14.8%

The year closed with a good return, but giving back a lot from the 24/26% zone where I was at the end of September. I will cover the Q4 drawdown in more detail later.

Regarding the year, the main drivers of returns were Emerging Market names, both up and down (FXI, VIST, BLX, JBSAY, AFYA, VINP and LOMA, ORBIA, MRVSY on the negatives).

Brazil represented about 42% of the yearly average long weight, with a contribution of -1.8% (or -4.2% return). Compared to the EWZ, down 35% for the year, and the dollar-denominated IBOVESPA index, down something like 28%. It’s not such a terrible performance, with MRVSY explaining all of the losses and then some more (more on MRVSY later).

China was a positive trade and driver, but I don’t feel particularly proud about it. As mentioned in my first portfolio article, I suspected that China was too cheap at $25 for the FXI in July 2023 and then added some more at $20 in January 2024. Although the market saved me, my process was not good, and the position grew pretty significant for a speculative one (although it must be said that I bought half of it at GFC bottom levels, so with some ‘margin of safety’).

As part of Q4, I added two positions in Mexico that are currently underwater (ALPEKA and ORBIA) and a short in Argentina (GGAL). The new positions section will discuss them in more detail.

Apparel and footwear in the US was another large sector, with many positions (VFC, PLCE, GIII, WEYS, RCKY, ANF, CROX, GES, PVH, DXLG) for a total average long weight of 43.6% and a contribution of 4.77 % (or 11% return). The S&P500 Consumer Discretionary Index was up 28.7% for the year; the Apparel Retail SubIndustry Index was up 26.4%; and the Textiles, Apparel and Luxury SubIndustry (kind of like Apparel Manufacturing) Index was down -15.5%. Overall, I think I underperformed in this sector regarding selection but not so much in allocation.

About putting 2.6% of the portfolio in OMEX options, I can’t say much, I was very stupid, and should’ve known better.

Q4

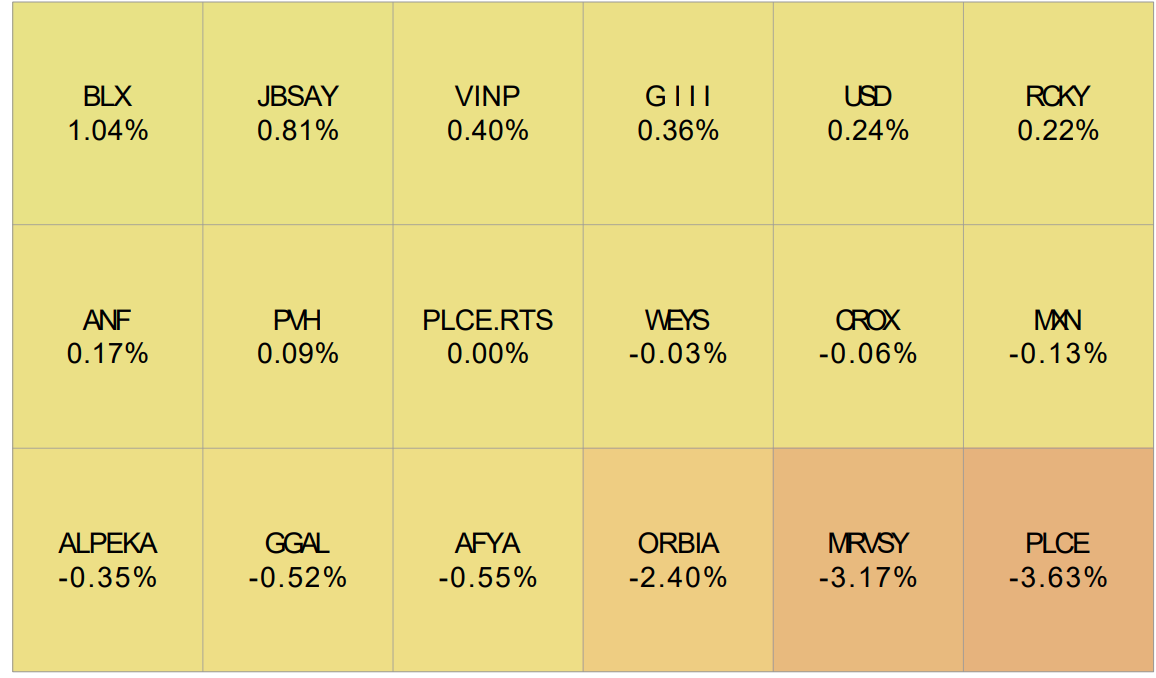

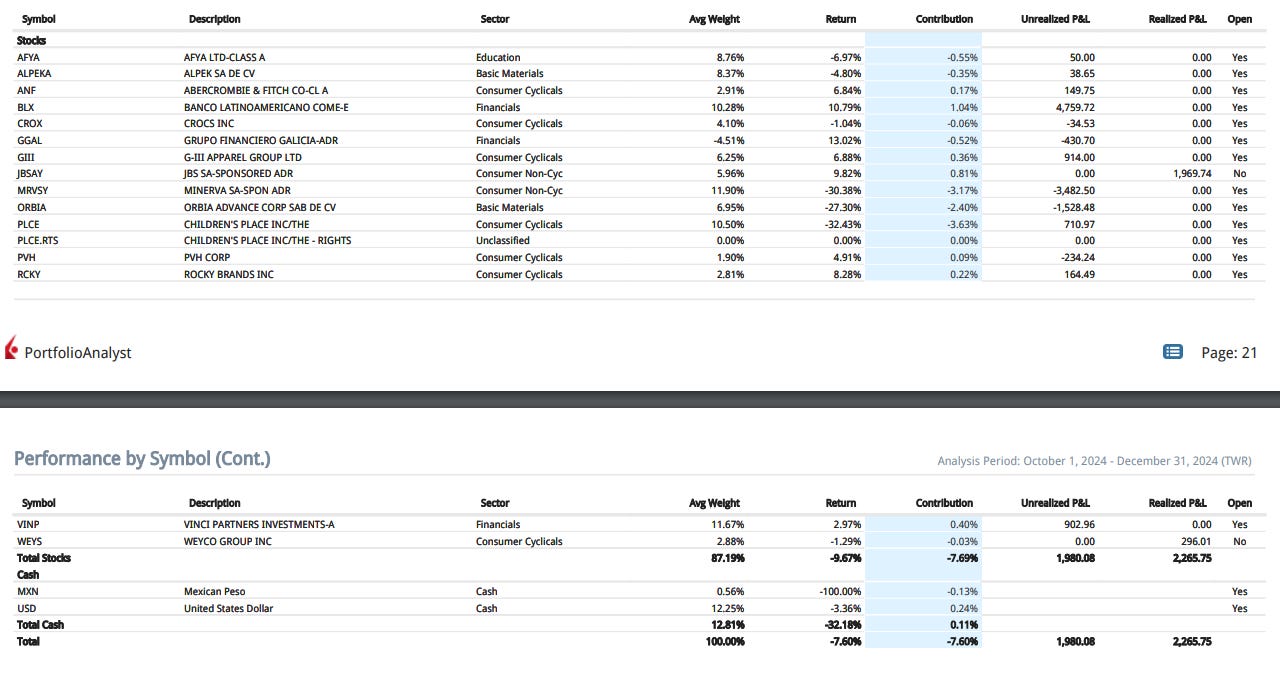

Q4 return: -7.6%, with -6.2% only in December.

It was a hard quarter, with large losers and not very big winners.

On the losing side, PLCE, MRVSY, and ORBIA were the main drivers.

PLCE

PLCE moved from a high of $18 at the end of September to $10.5 in December. This was mainly explained by two reasons, I guess: the announcement of the rights offering plan that will almost double the share count (with uncertain effects on debt) and Q3 results with wider losses in comparable sales than originally expected. PLCE started rallying in Q2 when the new management and owners (Mithaq capital, 55% of shares plus $160 million in debt to the company), managed to grow gross margins by 10pp while losing ‘only’ 8% of comparable sales. However, in Q3, the improvement in gross margins was much lower (2pp), with a 17% loss in sales. Since then, the company has released info on comparable sales up to the week before Christmas, down 8%. Considering the after-offer shares (21.8M) and offer price ($9.75), the company has a market cap of $212M. If we assume volumes (CoGS) are down 10% NTM to $890M, but gross margins go up to 35%, minus $410M SG&A and $35M interest, we get $25M in net income. On NTM volume sales down 5% and gross margins at 35%, net income is $45 million. The current gross margin is 31%, but 4Q23 and 1Q24 (pre-Mithaq) combined gross margin is 26.5%, because of huge discounting versus 35% for 2Q24 and 3Q24 (post-Mithaq).

It all hinges on Mithaq's execution, given that lower sales without the margins mean large losses. Like the situation for so many low-margin retailers, the difference between a few points of sales or margins is the difference between glory and death. I think the strategy of cutting on discounts is correct and that Mithaq has a lot to lose on this bet (their average price on their 7 million shares is probably between $70 and $100 million, and they also invested $160 million in company debt). In addition, the open short interest in this name is 3 million shares, and Mithaq can potentially end up owning 16 million shares of a total share count of 21.8 million post-rights, meaning the shorts will be way more than 50% of the float. The rights are non-transferable, meaning that if a share is in the hands of a trader, the right will probably not be exercised by the registered owner, allowing Mithaq to exercise.

MRVSY

I started considering MRVSY cheap at $6 and doubled my position at $4 in Q4. It now trades at $3.8. To say that this was challenging is an understatement, as it has been quite painful. In retrospect, my timing was awful. I saw a path to the company earning $250 million in net income against a market cap of $880 million. I thought that this would become evident, so I entered the position a year before the acquisition was effective. We still don’t have pro-forma financials on the acquisition numbers (first in March 2025), but the company has said it will not meet its BRL 5 billion pro-forma EBITDA guidance. The depreciation of the BRL and the weight of debt before any assets (MRVSY paid 1/3 of the acquisition one year and a half before taking control of the assets) have not been positive. If the company had met the pro-forma EBITDA guidance, then it could have generated something like BRL 1 billion in FCF post-interest and post-taxes versus a current market cap of BRL 2.8B. The timing was bad.

Going forward, I still believe the company could reach BRL 1 billion in FCF in FY25/26. The main risk is the cattle cycle. The Brazilian cattle cycle is at top levels, and higher slaughter of heifers (the first sign of a negative turn) is already happening. Minerva is somewhat protected from the cycle because it has big operations in other South American countries and because the growth in the Brazilian herd offsets some of the effects of the cycle historically.

New positions: Mexican chemicals (Alpek and Orbia)

I added two new positions in the Mexican Chemicals space, Alpek and Orbia. I wrote about the thesis on both of them in the Mexico Industrials article. Both companies are large players in their sectors (PVC for Orbia, PET for Alpek), with a large market share excluding Chinese players. Despite their markets being in absolute shambles in terms of margin, these companies are still profitable operationally and financially, meaning they are not marginally profitable players. Both trade at very low levels, currently at a P/E of 10x on the current cycle-bottom earnings, offering a 25% yield on cycle-average earnings. Orbia has moved down a lot because PVC prices in China continue to go down, even though Orbia's margins are better because of shipping costs. Both have also suffered from the MXNUSD depreciation

New positions: Short Argentinian Banks (GGAL)

I opened a short position (the first ever on my account) on Banco Galicia (GGAL), the leading Argentinian bank, at about $55/ADR. The thesis is simple: the carry trade and dollar appreciation system applied by the Milei government (I described it in detail in April 2024) leads to the appreciation of Argentinian balance sheets and peso returns. This is most evident in banks. Owning peso-denominated government debt paying 4/5% per month, with the government guaranteeing an official FX depreciation of 2% per month (2/3% real USD interest PER MONTH), plus intervention in the financial free FX rates to lower them by 40%, leads to a lot of dollar-denominated earnings and appreciation of the balance sheet. The problem with this scheme is that the peso mountain grows, and the dollar mountain doesn’t. If, at some point, the owners of peso portfolios want to dollarize their portfolios, there are no natural sellers.

Just some figures: the Argentinian Central Bank’s net liquid reserves (the dollars it owns) are close to negative $8 billion. Its gross reserves (which include the USD bank deposits of the private sector) are higher at a positive $30 billion. This is available firepower for the Central Bank, but it implies selling something it doesn’t own. The Argentinian current account surplus is about $5 billion per year (with the expectation that oil exports will add another $5 billion of net exports every year). Compared to this, the peso-denominated debts of the Treasury and Central Bank have grown from ARS$ 60 trillion ($70 billion) in December 2023 to about ARS$ 215 trillion ($208 billion) in December 2024. These figures are using official FX rates. Using financial, somewhat more free FX rates, the numbers are even worse because the rate fell close to 40% since December 2023. That means peso debt has grown 300% in a year with ‘only’ 160% inflation and that there’s no dollar reserve in the economy that can convert those pesos to dollars at the current rates.

This situation seems ‘reflexive’ in George Soros’ terms. Some portfolio owners get anxious about 2025 (mid-term election year with candidacies presented in May 2025 and elections held in August or October 2025) and decide to dollarize. There are few sellers, so the price moves up. Now, more people feel anxious, adding to the fire, and so on. The match that lights the fire is simply a few managers that look at the weighting scale, with one side holding the carry a few months (3% return in dollars per month) versus the risk of having the currency depreciate 50% in a few weeks. I think at least a few people will start to weigh the risks more heavily than the benefits as we get closer to the election.

From a charting standpoint, it’s simply beautiful. Argentinian boom and bust at its peak.

New positions: Long Crocs (CROX)

I bought CROX for about 6% position at about $110 after 3Q24 earnings. The company traded (and still does) at a P/E of 8.5x for FY24 expected earnings, while Crocs (the brand) is still growing units 11% YoY (17% International and 2% US market). The company’s margins are expected to fall in 2025 (already falling about 1.5pp in 2024 versus 2023), but this comes exclusively from Hey Dude, with Crocs margins falling 1pp versus 3pp for the company. I think the market expects Crocs to give back a lot of the sales and margins of the post-pandemic period (I wrote about this bear thesis in my Footwear Primer). However, the unit data, up 11% for the year, is still very strong.

New positions: Sell JBSAY, add MRVSY

I already commented on doubling the size of the MRVSY position but not about selling the JBSAY position. JBSAY is in a different spot because the company was repriced much faster due to the improvement in the cycle of most of its markets (mainly poultry and swine in the US and beef in Brazil). The company had some fuel left, potentially coming from a recovery in the US cattle cycle, but I considered that it was already fairly to slightly overvalued on an aggregate cycle basis.

New positions: Sell WEYS, Long RCKY

WEYS and RKCY have a similar thesis (also discussed in the Footwear Primer). Both own small brands in footwear, some of which have been very hit by post-pandemic cycles. In the case of WEYS, they were formal male dress shoes, and in the case of RCKY, they were outdoor footwear. I considered that WEYS had weathered the down portion of the cycle fine, with not such a big loss in gross margins, and that; eventually, an inventory restocking from retailers would occur. This did not happen, but the stock was repriced, so I sold it for a small 20% return. Much to my pain, after I sold, the stock squeezed 20% after 3Q24 earnings on very little news. These are things that I will never understand about the markets.

On the other hand, in the same earnings season, RCKY was down 20% after earnings, and I considered the situation very similar. Based on current earnings, the name offers a yield of 16%. This is the yield generated by a relatively challenging destocking period. If the company can grow revenues in a restocking cycle, then it may be repriced upwards.

Reviewing the 2024 ideas

2024 was… prolific.

On the Quipus Capital blog, I studied the following sectors: salmon breeders, Latam foods producers, US apparel and footwear retailing and manufacturing, Brazil’s banking, financial, and education sectors, and Mexico's industrial sector. I also covered some of China and the carry trade situation in Argentina. There were other framework—or philosophy-based articles, too. On Seeking Alpha, I wrote 300 articles, which, at an average of 1,000 words each, is like half a BIBLE. Most of them are just quarterly reviews of the names I covered on the blog.

I’m often more excited about moving forward and learning about new businesses than reviewing the ones I have already studied to some degree. Fortunately, covering quarterly earnings for Seeking Alpha helps me keep in touch with most of the names. Still, sometimes, I feel like I don’t create a proper actionability/opportunity ranking based on the ideas I know about, so this is a good point to start.

This section's goal is not to provide a lengthy overview of the ideas and sectors (links to specific articles will be provided) but to see if anything has changed, fundamental or profitability-wise.

The order in which the sectors or names are presented is based on what I believe to be the degree of opportunity.

Brazil Banks and Financials: The Brazilian bear market has been significant. Last year alone, the IBOVESPA index fell close to 30% in USD, now close to COVID and GFC levels (in USD). I am no market timer and will not comment on whether or not this year the trend will reverse. I do think that the political system is working out the primary deficit problem.

Long-term, I’m even more bullish Brazil. I find lots of quality companies, management quality is high, ROEs are high, and I think the country has an interesting strategic position in the ‘multipolar world.’ The banks and the financials (covered here and here) are some of the companies most levered to a recovery of Brazilian financial asset prices. Directly for the financials because some deal with investments and benefit from a higher stock market (XP, B3, Vinci). Indirectly for the banks because a positive financial asset cycle tends to go in line with currency appreciation, making bank balance sheets more valuable. These companies are still growing at double digits (yes, in BRL, but local inflation is MSD even now) and trade at 10x P/Es.

Salmon farming: This sector is not particularly expensive. The multiples are ‘high’ (15/20x) but are based on a cyclical downturn. The quality of the economics of the sector are undeniable. I kind of forgot about salmon because of the long-term view that rents will make land-based farming possible, but a reader correctly pointed out that this is in the long-term future. I will work more on salmon this year.

The Argentinian carry-trade unwind: Explained above with the short on GGAL (4Q Portfolio changes section). I think this will be one of the big widow-makers of 2025.

Mexican industrials: With Trump in office, some of these names are more uncertain, particularly the industrial REITs and the cement manufacturers (as they depend a lot on general activity). Others are not as affected, such as the Chemicals (thesis explained above, Orbia and Alpek), because their production is not so tied to Mexico and their markets are more global.

Apparel and footwear: Talking of these as a single sector is impossible. We have apparel, footwear, retailing and manufacturing, and many different categories inside.

We have super cheap value that might go bankrupt (names like DXLG, DLTH, TLYS, CTRN, WEYS, RCKY, DBI, etc.), but that could also offer 25% FCF yields in the near future.

We also have relatively expensive names in the most valuable brands (mostly footwear like DECK, ONON, BIRK, but also RL, KTB, LEVI).

I think the opportunities for research lie in getting high-frequency data or something similar on the value retailers, as the difference between a 25% FCF yield and bankruptcy is generally 2pp of sales or margin, and apparel fast-fashion (GAP, ANF, URBN, AEO) because the multiples are not super high, although cyclically, they are on a top but have really reinvented themselves. Nike’s turnaround could also be interesting, although it seems more competitive to gain an edge on it.

Brazil education: This sector has three companies with US ADRs, one of which I own (AFYA, covered here and here). The other two are Cogna and Vasta. Cogna is super levered and has a bad business, I don’t like it even cheap. Vasta (owned by Cogna) has a better business, and could be an opportunity given the operating leverage economics it enjoys, and lower competition. Still, it’s not screaming quality and low prices as other stuff in Brazil.

Meatpackers: In most cases the Brazilian meatpackers have already repriced to their cycle-average levels, so that there is not so much opportunity. I’m still waiting on Minerva ($MRVSY) above, but it’s quite risky.

Latin American agricultural commodities: The cycle in agricultural commodities is definitely down, but it tends to remain down because of the economics of the sector (see the Cyclicals Framework). I don’t think these are very interesting.