Apparel Series IV: Company reviews

Business and valuation assestment for 36 public apparel retailers and manufacturers.

After an extensive discussion on the technical aspects of the apparel market, it's time to move from theory to practice. To do this, I analyze the business quality and valuation of 36 apparel companies based in the US.

This analysis builds upon the framework and key aspects discussed in my ongoing Apparel series. Here is an overview of what I've covered thus far:

Part I: A general discussion about how apparel companies compete, why B&M stores are not dead, and why the segment can offer profitable and competitive niches against mega-retailers like Amazon or Shein.

Part II: Deeper dive into the world of apparel retailers, as differentiated from apparel manufacturers/designers. The article explains some of the retailers' most common pitfalls, including heavy discounting and over-reliance on third-party brands. I also discuss recent challenges from ultra-fast fashion retailers like Shein.

Part III: An article about apparel manufacturers/designers and the world of fashion. It starts with a general framework to analyze fashion brands and the management of their intangibles, some possible segmentations of the market, and finally, some of the challenges that apparel designers face (like relatively small TAMs, fashion cycle risks, or difficulties moving downstream to retailing).

In this article, I perform an in-depth analysis of each company, including links to individual articles on Seeking Alpha, and then summarize the key strengths and weaknesses of each company in a table.

In the summary tables, I provide a very short business assessment and a valuation rating for each company. The business evaluation rating (bad, mid, good) condenses aspects like management quality, level of leverage, competitiveness of the end market, recent strategy, and returns on capital. Readers unfamiliar with these companies might find these business evaluations too succinct, so I recommend you read the condensed analysis or the individual articles if you do not know the companies. The valuation rating (high, fair, or opportunistic) is based on my risk appetite, trying to be pretty conservative.

In the condensed analysis section, I provide a concise summary that includes a company introduction, its strengths and weaknesses, and its valuation. The valuation is presented as EV or market cap relative to the guided/forecasted operating or /net income. This helps you assess if the ratings in the summary tables match your risk tolerance. Additionally, each company analysis also links to the long(er) individual articles from Seeking Alpha.

Depending on your knowledge of the companies and the sector, you might find the individual articles, condensed analyses, or tables more useful. If you disagree with any of my takes, please feel free to reach out to me at tandrade@quipuscapital.com. I would love to discuss the thesis via email or phone.

As always, if you liked it, please subscribe and share. It helps me a lot!

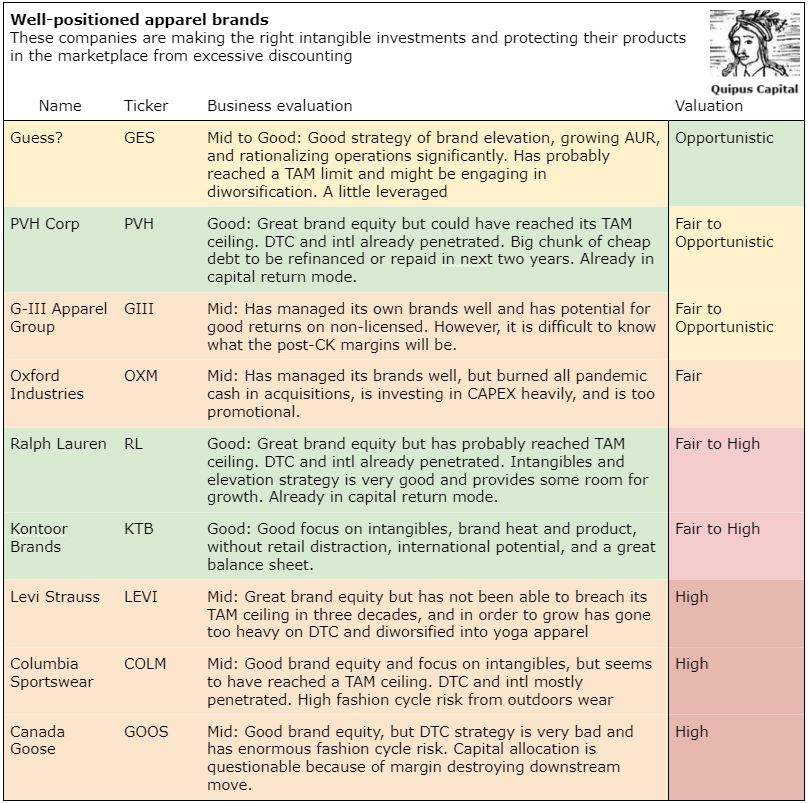

Summary tables

Unfortunately, the summary tables are uploaded as images, which may not be accessible for those with visual impairments. If that’s the case, please write to me, and I will send you a text version.

Well-positioned apparel brands

Guess? - GES - Seeking Alpha article

Originally a streetwear retailer, has transitioned to an aspirational lifestyle with a much higher design component. Suffered from significant activist and cultural problems for years, which now seem to have been solved.

The good

It restructured operations in 2019: SKU rationalization, rebranding into aspirational lifestyle, SG&A cuts.

This seems to have paid off via higher AUR (ex: handbag in 2018 average $100, versus $400/500 now), and controlled SG&A.

CEO (since 2019) is the same that ran the company in its glory years between 2000-2010. Seems to have struck a good relationship with Creative Director Marciano.

Strong shareholders (Marciano brothers, 42%).

The bad

Seems to have reached a TAM ceiling a few years ago. Recent acquisition of Rag & Bone might be diworsification effort.

Leveraged, $300 million cash versus $350 million in convertibles at $25 maturing 2028 and yielding 3.75%, plus $150 million in credit facility.

Recent margins are in part the result of elevated store productivity.

Valuation: EV of $1.5 billion versus guided operating income of $232 million.

PVH Corp. - PVH - No Seeking Alpha article published yet.

Owner of Calvin Klein and Tommy Hilfiger, both in aspirational luxury with potential for lifestyle diversification.

The good

Brand equity (40M followers IG and Tiktok).

Protecting pricing instead of promoting in this environment.

Good focus on intangibles (recent CK campaigns with Jennie Kim, Jung Kook, Kendall Jenner and Jeremy Allen White; TH still directed by TH himself, with two global runways)

However, with high marketing investment (8% of revs, $700M) it could do much more.

Heavy shareholder return policy (TTM buybacks $600M vs CAPEX $250M)

The bad

Seems to have reached a TAM ceiling a few years ago. The recent strategy of bringing back licenses and expanding DTC confirms this.

Has not been able to expand outside of CK and TH. Divested smaller failed brands in FY21 and FY23.

Large chunk of low fixed rate debt maturing in 2024/25, which if refinanced will increase interest costs.

Retail weight is high (50%), diverting attention from brand and product.

Ex-US market already penetrated (65% of revs)

New management is untested (new president in HF, and CEO in CK in 2023/4).

Valuation: EV of $8.11 billion vs guided operating income of $865 million.

G-III Apparel Group - GIII - Seeking Alpha article

Apparel wholesaler, owner of twelve brands, mostly in the luxury space (Donna Karan, Karl Lagerfeld, Vilebrequin, 50% of revs). Challenged because it will lose half of its revenues (and maybe more in profits) from Calvin Klein and Tommy Hilfiger licenses.

The problem for valuing the company is we don’t know the margin of the portfolio brands that will remain when the CK and TH licenses expire. The company’s brands are 40% of sales, so their margin can’t be meaningfully different from the company’s average margin, of about 7.5%.

The good

Company has been able to grow its own brands.

Management expects 15/20% margin from its brands, in line with best brand-level (ex-corporate) brands in the segment.

No retailing, full focus on intangibles and brand building.

Owned brands do have equity (KL instagram followers 6.6 million, DKNY 3 million). They generate $75 million in license income.

Managed by the founding family, CEO is largest shareholder (10%).

The bad

We don’t know the operating margin of the remaining brands.

A little leveraged, $500 million cash, $400 million in 7.75% notes maturing 2025.

Valuation: Current EV of $1.2 billion, but remaining two years of CK business is worth $170 million. On the $1.5 billion own-brand business, the company would need a margin of 9.5% to generate NOPAT of $110 million.

Oxford Industries - OXM - Seeking Alpha article

Lifestyle brand conglomerate focused on vacation wear. DTC and US focus (80% of sales). Brands: Tommy Bahama (mostly male aspirational), Lilly Pullitzer and Johny Was (resort lifestyle for women), and other emerging brands.

The good

Generally high operating margins (~10%) with very good returns on capital (~15%).

Has shown a great ability to grow the brands it acquired (LP, TB).

Long-standing management team.

The bad

Recent revenue growth has been explosive, risk for reversal.

DTC focus removes attention from intangibles, which are important competing in the higher price segments.

Too much focus on promotionality for high-priced brands.

Low brand equity (less than 1M followers between three largest brands).

No controlling shareholder.

Spending heavily on CAPEX ($200M in FY24) despite low cash (<$20M). Plans to finance with EBITDA.

Valuation: EV of $1.7 billion, vs operating income of $195 million at current (~12.5%) margins, and $157 million at historical (~10%) margins.

Ralph Lauren - RL - Seeking Alpha article

The poster child of the aspirational lifestyle conglomerate. Eleven global brands across three price segments, and ten product categories, all around the Ralph Lauren core.

The good

Great aspirational lifestyle coverage, can sell from $80 top to $10k tuxedo.

High brand equity (60M followers across brands and social media).

Fantastic intangibles management, a lot of brand heat with ~7% of revenues (ex: Taylor Swift endorsement, Korean T1 LoL team, China Year of the Dragon campaign, Beyonce tour dress).

28 quarters of growing AUR, potential to expand operating margins above 10/11% average.

Capital return policy (buybacks + divs ~ $600 million vs CAPEX of $200 million).

Strong balance sheet (debt is low rate fixed matures mostly in 2030).

The bad

Seems to have reached TAM ceiling a long time ago. Retail is already 65% of sales, international is 55%

only potential is women, 30% of revenues.

Key person risk with RL (84) still involved in creative decisions

Quiet luxury trend might have been short-term tailwind

Valuation: EV of $10.2 billion vs guided operating income of $850 million.

Kontoor Brands (KTB) - Seeking Alpha article

Owner of denim brands Wrangler (western and casual) and Lee (streetwear). Almost purely wholesaler (88% of revs) and US-focused (80%+ of revs).

The good

Wholesale weight means it must focus on brand and product, not retail operations.

Focus on intangibles investments evident in calls, many collaborations with other brands, celebrity activations, and product development

Post-covid SG&A reduction thanks to the restructuring plan, op margins > 10%.

US wholesale weight generates a short-term negative bias to lower revenue growth.

Strong balance sheet (debt at low fixed-rate and matures 2026/2031)

Potential for internationalization

The bad

Denim cycle might be short-term tailwind.

Valuation: EV of $4.4 billion against management’s guidance of $380 million in operating income.

Levi Strauss & Co - LEVI - Seeking Alpha article

Owner of Levi’s, the largest denim brand in the world. Also owns Dickies (strong on khakis wholesale) and Beyond Yoga (women athleisure).

The good

High brand equity (30M followers between Ig and TikTok).

Strong balance sheet (debt at low fixed-rate and matures 2027/31).

Initiated restructuring plan in corporate jobs (10/15% of that workforce).

Strong controlling family.

The bad

Reached all time high sales in 1996 ($7 billion), never surpassed that.

Focus on DTC (45% of sales and growing) removes attention from intangibles. Heavy CAPEX on store openings (10% fleet expansion next fiscal year)

Move downstream (20 pp in the past 10 years) has been unable to increase operating profits.

Diworsification strategy with the purchase of Beyond Yoga.

Historical op margins are not great (<10%)

International is probably already saturated (55% of sales).

The denim cycle might be a short-term tailwind.

Valuation: Market cap of $8.65 billion vs guided net income of $472 million.

Columbia - COLM - No Seeking Alpha article.

One of the mass market leaders in outdoors. Besides Columbia, it owns emerging brands like prAna (yoga), Mountain Hardwear (mountaineering), Sorel (footwear).

The good

Focus on intangibles (ex: Omni-heat lunar mission, Mark Hamil campaign, Mountain Hardwear redesign, stores on the Everest and Peru fishing locations, product development in footwear and PFG).

No financial leverage, long-term management, strong controlling family.

Opportunities in China and the void left by North Face.

Restructuring the corporate and supply chain functions to recover margins.

Returning capital (buybacks and dividends of $300 million vs CAPEX of $50 million).

The bad

Excessive promotions still not fully corrected, although inventories are already down to pre-pandemic.

General risk of the outdoors/performance cycle.

DTC already penetrated (50% of revenues) and probably stealing attention from brand and intangibles.

International opportunity somewhat penetrated (35% of revenues)

Valuation: EV of $4.2 billion vs guided operating income of $290 million on the upper range.

Canada Goose - GOOS - Seeking Alpha article

Luxury outdoors wear brand, famous for its parkas (retailing for $1,500/2,000). One of the representatives of the gorpcore trend.

The good

Brand equity is high, otherwise people would not pay $1.5k/2k for a parka.

Recently recognized store productivity problems and is slowing down store openings.

The bad

Store model is difficult to implement because sales are highly seasonal, and the store locations are expensive luxury areas.

The company made this worse by expanding aggressively and fast, cannibalizing wholesale, and into some weird locations (recent example, Hawaii in 1Q24).

Competition in the luxury gorpcore world from more fashion oriented brands like Arc’teryx and Moncler.

As a representative of gorpcore, it has significant fashion cycle risk.

Some signs of corporate extravagance like new headquarters in Toronto.

Valuation: EV of $1.55 billion versus guided FY24 operating income of $120 million.

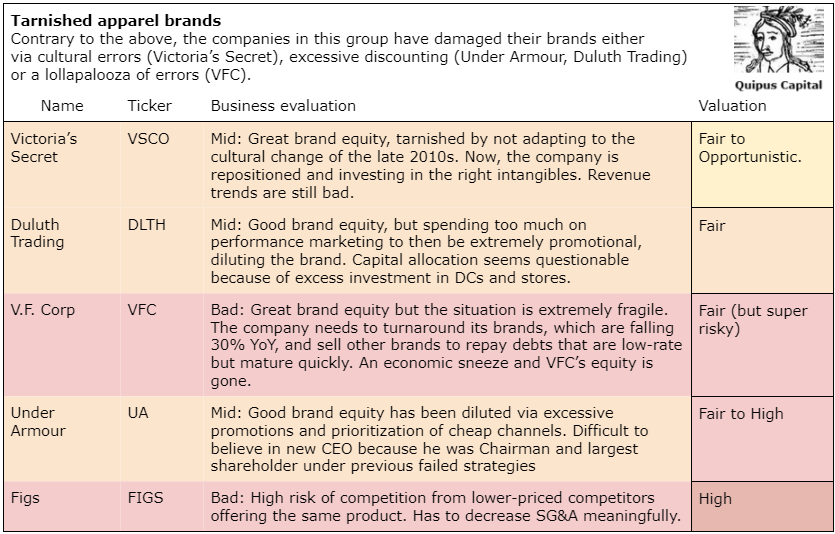

Tarnished apparel brands

Victoria’s Secret - VSCO - Seeking Alpha article

Historical leader in branded women innerwear. The company reacted terribly to the feminist movement but now is repositioned.

The good

Extremely good brand equity (75 million Instagram followers, above Chanel, Zara, or Ralph Lauren).

Already repositioned to current cultural trends. Investing in correct intangibles (relaunching VS Show, enlisting strong female figures as angels, ex: Megan Rapinoe, Priyanka Chopra, Mariah Carey, and Naomi Osaka).

Repositioning is possible because VS was not always sexy blonde innerwear, in the 1980s and 1990s it was a classy brand.

International still provides room for growth (25% of revenues).

Good license business (fragances is 1/3 of revenues).

The bad

After two years of restructuring, sales are still falling. Continues to be very promotional.

A little too weighted towards DTC (900 DOS in the US).

Diworsification strategy with the purchase of Adore Me (e-comm innerwear) at 2/3x sales.

A little leveraged ($600 million maturing 2029 at 5%, $400 million at SOFR + 3.5%, $270 million cash).

Valuation: EV of $2.5 billion vs guidance of $270 million in operating income.

Duluth Trading - DLTH - Seeking Alpha article

Outdoor/Workwear brand. Originally a DTC ecommerce company that expanded heavily into retail.

The good

Has some brand equity from investment in good ad campaigns in Youtube.

Founder/Chairman owns 60% of the stock.

The bad

Promotions are eroding the company’s margins and diluting the brand. Most of the time their webstore has 40/50% off everything.

Extremely heavy on marketing (15% of sales) which are probably mostly performance. This is contradictory with high promotions.

Size format is huge, at 14k square meters, requiring high traffic and year-round utilization.

This probably led to excessive expansion into unrelated SKUs (ex: gardening, women swimwear, pet products).

No signs of the company changing strategies in the calls.

Not a big cash cushion ($30 million versus $25 million in debt as of 4Q23).

Valuation: EV of $145 million versus current negative operating margins. At historical 5% margins, operating income would $32 million.

V.F. Corporation - VFC - Seeking Alpha article

Owner of The North Face, Timberland, Vans, Supreme, Dickies, and others. Driven to the ground by terrible merchandising and high leverage. Now trying to turn around. Capital risks are real.

The good

Brand potential is high, but this depends on relatively untested management. I like the directions given so far.

Management is untested but comes from a previous restructuring at Logitech.

The bad

Super leveraged, $6 billion in debt, generally at low fixed rates, but has $1.8 billion maturing in 2024/25 that will need to be paid by selling brands.

Because VFC’s debt has such a low rate, it is critical that management only pays the debt as it matures instead of selling core brands.

Sales are collapsing in Vans (25%), Timberland and Dickies (15%). In part, this is driven by clearance, but needs to stop quickly.

Fashion risk is high because the gorpcore/techy style has been in vogue and may turn.

Make or break situation, any economic sneeze and the whole company collapses (inability to sell brands at reasonable prices, collapsing sales of products).

Valuation: Market cap of $4.5 billion, versus net income of $325 million assuming the company’s sales remain at 4Q24 levels (down 25% from FY24), but $780 million assuming recovery of margin (11% versus current 6%) at current sales.

Under Armour - UA - Seeking Alpha article

Sportswear brand. Mostly wholesale (65%) and US (65%) based. Higher apparel focus than traditional sports brands (Nike, Puma, Adidas). DTC revenues come mostly from ecommerce.

The good

Lean(er) structure because most of its revenues come from wholesale and e-commerce.

Strong balance sheet ($1 billion cash versus $600 million at 3.25% maturing 2026).

New plan seems to point in the right direction but comes from the same Chairman/CEO/owner/founder that had approved a completely different plan a year ago.

The bad

Brand has been diluted via excessive promotions and prioritization of cheap channels.

Wholesale reads into Fy25 are very bad.

Bloated corporate structure (13% of revenues).

Five CEOs in five years, while the company’s founder/Chairman/CEO/largest-shareholder was in charge of strategy.

Not a great history of capital allocation with purchase of running apps in 2015 at bloated valuations.

Valuation: EV of $2.7 billion, compared to guided operating income of $140 million ($220 million pre-restructuring).

Figs Inc. - FIGS - Seeking Alpha article

The company made its name by innovating in healthcare worker scrubs. The segment was a commoditized, low quality product market and the company created a brand of high quality, ‘fashionable’ products.

The good

Good brand equity in its community, still sustains 70% gross margins.

High concentration on very few SKUs provides a lot of manufacturing and inventory efficiencies.

Strong balance sheet ($260 million in cash, no debt). Mostly financed via huge SBC (10% of revenue).

The bad

Despite high gross margins, company’s operating margins are low (5/7%).

SG&A to revenue is very high, this side of the business needs to be rationalized and management seems unwilling to.

The product is good but can be easily copied (same manufacturers copying the designs or improving the fabrics). With 70% gross margins, competitors have a lot of space to underprice Figs.

Valuation: EV adjusted for dilution is $970 million, compared with operating income of $30 million.

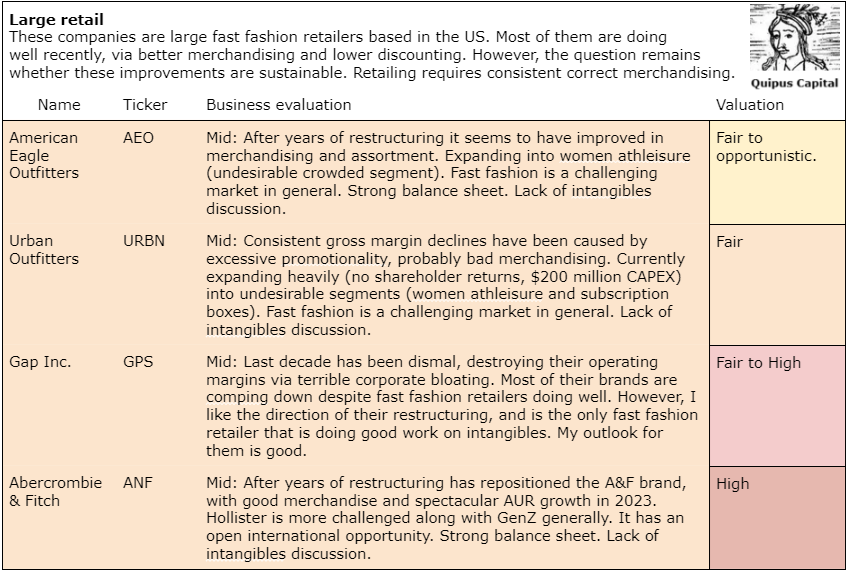

Large retail

American Eagle Outfitters - AEO - Seeking Alpha article.

Fast fashion retailer for millennial/Gen Z basics (American Eagle, ~800 stores), plus women's casualwear (Aerie, ~300 stores) and athleisure (OFFLINE).

The good

History of nurturing brands: Aerie and OFFLINE business more than 5x past 10 years.

Flexibility in terms of store footprint (average lease maturity 2 years), 40% of sales are online.

Very good recent results, especially when compared against a very challenging environment, doing well in merchandising.

Strong balance sheet ($450 million in cash, no debts).

The bad

Leaning too much into women's athleisure (plan to open 100 OFFLINE stores).

Given it is considered a leader in jeans, it might be benefitting from denim trend/fad tailwinds.

Corporate expenses are probably bloated (53% of brand-level operating income).

Lack of discussion of intangibles, most merchandise sourced via agents.

Valuation: EV of $4.1 billion vs guided operating income of $455 million.

Urban Outfitters - URBN - Seeking Alpha article.

Fast fashion retailer with diversified, mostly women-focused, brands (Anthropologie: millennial+, casual; Urban Outfitters: GenZ, streetwear; Free People: GenZ+millenial; FP Movement: athleisure), mostly US focus

The good

Relative diversification in price range and demographics (higher/older Anthropologie, lower/younger Urban Outfitters).

Long-term managers/owners, strong balance sheet ($500 million cash, no debt).

The bad

Growth mode: no capital returns (buybacks or dividends TTM) vs $200 million in CAPEX.

Growth and CAPEX in sportswear (Free People Movement) and subscription boxes (Nuuly), I don’t like these segments.

Sportswear is in trend and every retailer is investing there, and subscription models are not profitable generally and lead to high CAPEX impairments.

Urban Outfitters (the brand) is being sieged by ultra-fast fashion, just like TLYS and ZUMZ

History of markup destruction, probably related to merchandise failures.

Despite high marketing (6% of revenues), intangibles are absent from the conversation.

Valuation: EV of $3.4 billion vs current operating income of $390 million.

Gap Inc - GPS - No Seeking Alpha article yet.

THE American fast fashion retailer, diversified into basics (GAP), value (Old Navy), aspirational lifestyle (Banana Republic), and athleisure (Athleta).

The good

Good focus on intangibles across all brands (first Creative Director, athlete endorsements for Athleta, launching campaigns across all brands) at efficient marketing expenditure levels (marketing 5% of revs).

Cutting SG&A via franchising ex-US markets and corporate positions.

Used to have super strong margins for a retailer (10/15%) before 2015.

Strong balance sheet ($1.9 billion cash versus bonds at fixed 3.75% maturing 2029 and 2031).

Reducing promotionality.

The bad

Restructuring mode, very challenged in some brands, has brought new CEO and was posting operational losses recently.

Even today operating margin is low < 5%, meaning a downturn or challenge would put it back in red territory.

Reached a TAM limit in the early 2010s that has been impassable.

Valuation: EV of $7.5 billion versus guided operating income of $675 million.

Abercrombie and Fitch - ANF - Seeking Alpha article.

Fast fashion retailer for millennials (A&F, 250 stores), and Gen Z (Hollister, 520 stores), restructuring after a very challenging 2010s decade.

The good

Recent year restructuring is delivering, with higher store productivity, and a repositioned brand.

Good online penetration (60% of ANF, 40% at Hollister).

Improved pricing, driving tremendous AUR growth in 2023.

Probably good assortment is driving trends in 2023.

Digital brand equity is high for retailer (~10M instagram followers), consistently growing organic traffic.

Strong balance sheet ($900 million cash vs $200 million debt).

Potential to repeat what they did with A&F with Hollister.

International opportunity because of brand value.

Concentrated manufacturing base.

The bad

Hollister is challenged, probably as part of the general trend in Gen Z retailers.

Unclear whether the company can keep growing now that the AUR engine has been exhausted.

Valuation: EV of $9/10 billion versus guided operating income of $500 million.

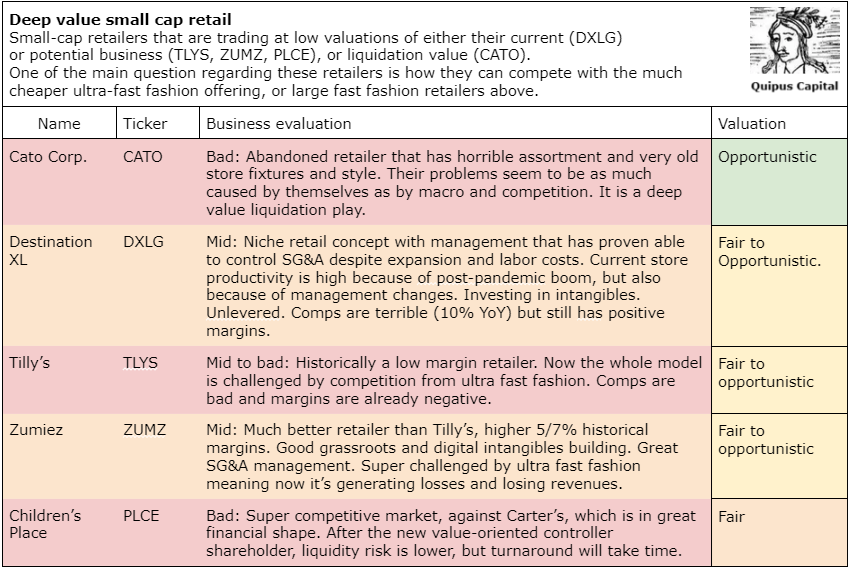

Deep value small cap retail

Destination XL Group - DXLG - Seeking Alpha article

Big and tall men retailer, full assortment in terms of pricing (good, better, best), and lifestyle (formal to casual and sports). 280 stores, all in the US

The good

Niche category generally not very well served by other retailers or apparel brands because it is difficult to carry inventory for it.

Good merchandise margins: gross margins of 45/50%, and 60% before rent.

Great SG&A management: SG&A fixed since 2019, despite 30% labor cost increases and $10 million increase in advertising.

New strategy of more investment in intangibles (brand campaigns, website redesign).

Strong balance sheet, $60 million in cash, no debt.

The bad

Digital is very nascent (although part of new strategy is to invest more in this).

Pre-pandemic operating margins were close to breakeven, compared to 8.5% now, difficult to separate what is macro from what is internal (current CEO arrived late 2019).

Weight-loss drugs risk.

It is a difficult segment to create brand emotional ties. I don’t think many people want to identify with being overweight.

Comparables are falling 10%, reducing store productivity and margins.

Valuation: EV of $140 million, compared with guided operating income of $22 million.

Cato Corporation - CATO - Seeking Alpha article

A historically large retailer (1,500 stores at its peak) that offered value/assortment for teenagers. Has not renovated in years and is now a liquidation play.

The good

Trades at 0.5x book, including $100M in cash and up to $50M in sellable property.

CEO, Chairman and founding family member owns 50% of stock, has interest in liquidating before running the company to the ground.

The bad

Generating operational losses ($15M in FY23) that could eat into the cash balance if the company does not liquidate.

The company has not made any innovation in years; their stores are old, and ugly, and the assortment is terrible.

Ecommerce totally neglected (6% of revenues, website is super old).

Valuation: EV of $20 million versus $700 million in sales. Even a small recovery in profitability is undervalued. On top of that it tradest at P/B of 0.5x (plus some upside on PP&E).

Tilly’s - TLYS - Seeking Alpha article

Streetwear Gen Z retailer with a focus in California (100 stores). Mostly focused on men. 260 stores total.

The good

Cash on balance sheet of $90M (Mcap $230M) provides some flexibility to turn the ship around without debt.

Controlled by Chairman and founder (founder B shares).

CEO replaced in January, potential for turnaround.

The bad

Really challenged by ultra fast fashion hitting their core Gen Z demographic.

Generating operational losses.

Digital is not great (ecomm 20% of sales, webstore assets are bad, traffic is decreasing post-pandemic).

Valuation: EV of $80 million versus current negative 5% operating margins. Return to pre-pandemic (~3%) margins at $630 million revenues implies operating income of $19 million.

Zumies - ZUMZ - Seeking Alpha article

Streetwear/Skating Gen Z retailer with a global footprint. Mostly focused on mne. 600 stores total.

The good

Good grassroots type intangibles investments (skater festivals, skater influencers, indie bands)

Digital brand equity is good (1M Instagram followers, local stores have accounts, discord channel has 40k members)

Historically a much better performer than Tilly’s, more growth at higher margins.

Very good SG&A management: grew store base 10% without new employees, and SG&A 8% higher than 2018 despite labor costs up 25%.

Despite the context, it is not resorting to promotionality.

Long-term management, CEO and CFO own 18% of the company, compensation is reasonable

Has $170M in cash (vs TTM op losses of $20M) and no debt

The bad

Really challenged by ultra fast fashion hitting their core Gen Z demographic

Generating operational losses.

Digital traffic is falling off a cliff.

Valuation: EV of $195 million versus negative margins (-7.5%). If it could return to 2010-2020 margins of 5/6% (low end of range), then operating income of $44 million.

Children’s Place - PLCE - Seeking Alpha article

Children’s apparel retailer, driven to the ground and close to BK by excessive promotions, saved by a value fund from Saudi Arabia.

The good

Controlling stake purchased by a value fund from Saudi Arabia that will try to turn the company around. They released a letter talking the value language but giving little information on changes

Controlling shareholders has provided financing at high but reasonable rates.

Most of the damage happened at markup level, with volumes still OK, so there is space for recovery.

Store flexibility, 75% of leases mature in 2024/25

Digital is 50% of sales but offers margins destructive free shipping on super low priced products (new management moved free shipping to $20/order).

The bad

Deep into operational loss territory, company drove gross margins to the ground (close to pandemic levels).

Mounting debt costs, a lot of leverage and no cash pre change of control

Valuation: Pro-forma EV of $520 million compared to historical average operating income of $75 million. In order to generate a 10% EV/NOPAT, the company should post gross margins of 32% at current revenues (37% historical margin).

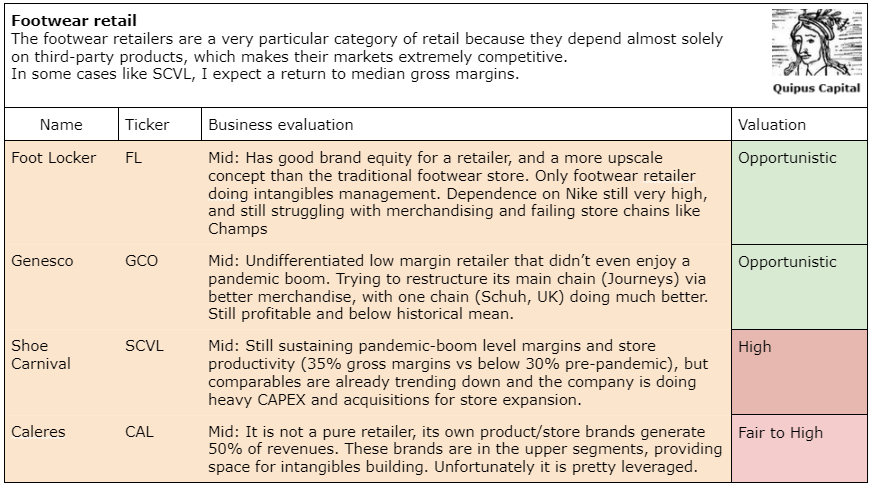

Footwear retail

Foot Locker - FL - Seeking Alpha article.

Largest US pure-play footwear retailer owns the namesake brand (65% of revenues) and smaller concepts like Champs Sports (sports), and WSS (Hispanic demographics). International is 30% of revenues. 2,600 stores.

The good

Whole management team replaced in 2023, started turnaround.

Potential to add brand value by being the sneakerhead destination. Investing in intangibles (NBA association, basketball court in some stores, basketball clinics).

Brand value potentially high (12M instagram followers).

Nike is re-evaluating its wholesale channel strategy, which could benefit FL.

Strong balance sheet with $300 million in cash and $400 million in debt at 4% fixed maturing 2029.

The bad

Margins collapsed post-pandemic, suffering from over-inventorying and Nike not providing them with good merchandise.

Inventory turns at historically low levels.

Still has a bid dependence on Nike (65% of revenues)

Past management team capital allocation decisions were not good, resulted in impairments of acquired chains.

Valuation: EV of $2.5 billion compared to current operating income of $122 million (1.5% margins). Operating income at historical margins of 7% would be $570 million.

Genesco - GCO - Seeking Alpha article

Footwear retailer focused on teenagers and kids (60% of revenues in Journeys brands), with operations in the UK (20% of revenues, Schuh group)

The good

Schuh is performing at record levels and helping on margins.

Trying to turn around Journeys via better merchandise and hiring a new creative agency.

Cash balances of $50 million, leaving little cushion for a prolonged downturn.

The bad

They never enjoyed a post-pandemic boom, and are actually suffering from over inventorying and lower store productivity. Operating margins (1.5%) are lower than historical (4/5%).

Heavy advertising expenditure (5% of revenues) with little intangibles building, signaling high investment in performance marketing.

Average lease term of 5.5 years does not provide a lot of fleet flexibility.

No controlling shareholder.

Capital allocation was bad, spending $160 million in share repurchases at $57/share versus less than $30 now.

Valuation: assuming 2% operating margins going forward, NOPAT of $32 million versus an EV of $300 million.

Shoe Carnival - SCVL - Seeking Alpha article

Value footwear retailer for the whole family with two chains: Shoe Carnival (lower priced, heavy in US rural Southeast), Shoe Station (more Midwest base and higher pricing).

The good

Gross margins are decreasing from a peak of 40% to 36% but are still way above pre-pandemic levels of less than 30%

A strong balance sheet with no debt and $100 million in cash.

Many stores are in rural areas of the Southeast were competition is probably lower and they can get better terms from suppliers because they provide market access.

The bad

Investing heavily in CAPEX (2x D&A) and acquisitions.

Acquired Shoe Station in 2022 and Rodgers in 2024.

Plans to expand store fleet by 25% by 2028.

Renovated 40% of the store fleet in 2022.

Comparables and margins are down, signaling that the post-pandemic trend is reverting.

Valuation: EV of $940 million compared to current NOPAT of $70 million, and NOPAT of $37 million considering pre-pandemic margins.

Caleres - CAL - Seeking Alpha article

Footwear retailer with a focus on women (60% of sales). Has its own brands and products. Owns the chain Famous Footwear and smaller brands (Sam Edelman, Vionic, Franco Sarto, etc.), total about 900 stores.

The good

It is not a pure retailer as their own brands generate 50% of sales and 40% of profitability.

Does their own designing of products with offices in China, prides on fast design turnaround (3 months)

Owned brands are in higher price segments which provide good potential for intangibles building.

Was already implementing SKU rationalization back in 2021.

Repaying debt from previous acquisitions, and decreasing SG&A heavily, particularly in corporate.

Their webstore is very good for a retailer of their size.

Long-term management.

The bad

Leveraged with debt of $300 million and $30 million in cash.

Average lease life of 6 years, little fleet flexibility.

Valuation: EV of $1.5 billion compared to NOPAT of $137 million at current 7% margins, high compared to historical margins of less than 5%

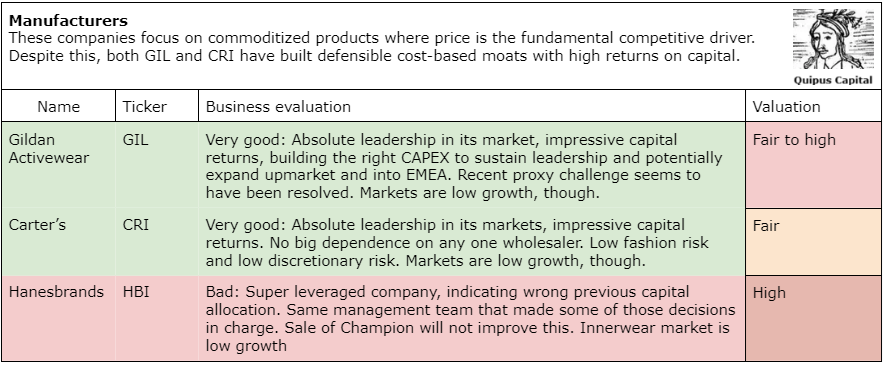

Manufacturers

Gildan Activewear - GIL - Seeking Alpha article.

Leader of the white label t-shirt market, with a big presence in US and opportunity in Europe. Board vs activist proxy contest seems ended.

The good

Absolute price dominance in the US market thanks to great manufacturing control. Their prices are 30% below the competition and still posts 15% operating margin.

Great capital allocation led to this price advantage and good capital returns (16%).

Recent expansion in Bangladesh provides a good opportunity to win market in Europe and upper-segments in the US (ring-spun cotton products).

Founder/CEO reinstated after a few months of proxy challenge, back to normal business.

A little leveraged but way below ROCE and could reduce it via EBIT.

The bad

Saturated market, low growth potential

Valuation: EV of $7.4 billion against operating income of $550 million.

Carter’s - CRI - Seeking Alpha article

Leader of the value baby market (Carter’s) and a player in children (Osh Kosh), mostly US presence.

The good

Leader in its market. Posting high (10%) operating margins on a very price-competitive segment.

Great historical capital allocation, 20 year avg ROCE of 18%. Past 10 year average ROE of 30%.

Despite wholesale being big, no client is more than 10% of sales.

Baby and children apparel not as discretionary and much lower fashion risk, more stable business.

Unlevered, $500 million in debt at 5.6% maturing 2027.

The bad

Saturated market, low growth potential.

Valuation: P/B of 3 for 10 year average ROE of ~30%.

Hanesbrands - HBI - Seeking Alpha article

Intro: owner of Hanes (leader in intimates) and Champion (streetwear). Heavily leveraged, restructuring and trying to sell Champion.

The bad

Super leveraged (net debt / TTM EBIT of 6x), at high variable rates (curr 8/9%)

The potential sale of Champion for $1B does not help too much in driving down leverage.

Same management team that drove the company to this bad position.

The intimates market is very mature, with little possibility for growth.

Valuation:

Pre-sale of Champion: EV of $4.85 billion versus operating income of $430 million. Market cap of $1.8 billion versus net income of $150 million.

Post-sale of Champion

Assuming $1 billion net proceeds and that Champion’s business is $1.5 billion today at 8% margins.

EV of $3.85 billion versus operating income of $310 million. Market cap of $1.8 billion versus net income of $130 million.

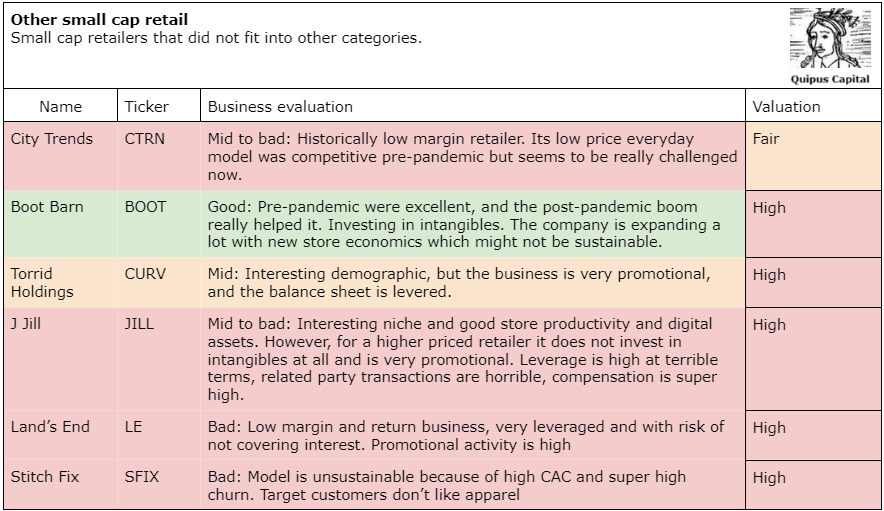

Small cap other retail

City Trends - CTRN - Seeking Alpha article

Low price every day retailer (not only apparel but mostly so) in low income neighborhoods of the US. Strong focus on women purchasers (for themselves and family) and US Southeast.

The good

Has $100M in cash (vs $18M operational loss in FY23).

Was able to compete at extremely low prices before Temu, so if those retailers retreat it could make a comeback.

The bad

Demographic and low-cost model is squarely against ultra fast fashion and cheap Chinese ecommerce.

Heavy into operational losses territory (Holidays FY23 only generated $5M op inc).

Potential activist (Fund 1 investments) was buying actively but Board established a poison pill.

Valuation: EV of $120 million versus current negative margins (-2.5%) but pre-pandemic operating income would be around $15 million.

Boot Barn - BOOT - Seeking Alpha article

Western specialty retailer (boots, hats, denim). Purely US. Explosive post-pandemic store productivity growth, difficult to explain.

The good

Good intangibles management, with participation in main country/western events. Partnerships with country artists.

Core customer is very conservative and not moved by fades or fashion.

Big potential to expand into Mexico and LatAm, where the cowboy style is very similar to that of Texas/Midwest.

Excellent operations even pre-pandemic, with margins expanding into the 10% range.

The bad

Store productivity is so high that it is difficult to explain it from intrinsic reasons.

Is it better economic conditions in the commodity producing states like Texas? Is it people getting on a trend?

Expanding heavily post-boom, with store returns that may be based on inflated productivity, adding to risk.

Same store sales are already down, potentially signalling decreasing store productivity. Same for webstore traffic.

Valuation: EV of $3.4 billion versus revenues of $1.7 billion (flat or comping down) and margins of 12% (down past two years) or $200 million op inc.

J Jill - JILL - Seeking Alpha article

Apparel retailer targetting adult (50+) educated women with no children. Aspirational casualwear, with no big branding. 245 stores in the US.

The good

Interesting demographic niche (adult educated women with high income and no kids at home)

Good mix between B&M (55%) and ecomm (45%)

Relatively good management of digital for their size (good assets in webstore, close to 500k followers in Ig + FB, live events, growing traffic)

Flexibility in retail footprint (half of stores renew lease in 2024/25)

The bad

Leveraged at bad terms (SOFR + 8%)

Terrible related party transactions in loans with controlling shareholder (Tower Brooks, 62% S/O). Bad terms and little disclosure

Unclear how much of current performance is post-covid lags

High-income demographic is incoherent with promotional strategy (webstore has 30/40% off as first UX)

Very little intangibles development (no mention of campaigns, product is sourced via agents)

Compensation is brutal for size, and based on terrible metrics ($0.25 of every $1 of adj EBITDA above $100M goes to bonus pool)

Valuation: EV of $440 million versus operating income of $86 million. Market cap of $365 million versus net income of $30 million.

Torrid Holdings - CURV - Seeking Alpha article

Retailer focused on plus-sized women, full assortment but specialty in innerwear. 640 stores

The good

Niche demographic.

Good digital assets in webstores. Relative good brand equity for core demographic (1 million IG followers).

Strong shareholder, Sycamore partners (80% of S/O).

Lease life of 3.3 years, providing flexibility.

The bad

Extremely promotional, Torrid Cash program ($1 for every $2 purchased) effectively meaning 33% off everything

Heavy dependence on performance marketing (~5% of sales)

Leveraged, $300 million in term loan at SOFR + 5.5%. Operating income is close to net interest expenses.

Valuation: EV of $940 million, against historical operating margin of 4% or $48 million

Land’s End - LE - Seeking Alpha article

Swimsuit and summerwear e-tailer, 95% of business is done online. Also has a school uniform B2B business.

The good

Historical CEO returned in 2022, cut corporate expenses and is rationalizing markets and products.

New management was able to recover gross margins via lower clearance, but heavy increase in SG&A indicates higher performance marketing used to drive traffic.

The bad

Leveraged with $250 million in debt, and $20 million in cash. Term loan of $250 million refinanced at SOFR + 8%.

Historically very low operating margins < 2%.

Returns on capital have been dismal since going public in 2015 (<5%).

Even considering 3% operating margin it would not be able to cover interest, it will probably need to issue equity.

Webstore shows a high level of promotions.

Valuation: EV of $560 million on an operating income of $30 million

Stitch Fix - SFIX - Seeking Alpha article

Subscription box e-tailer. People subscribe for a 5 piece box with apparel selected by a stylist. Customers can decide whether to keep all or some pieces.

The good

Strong balance sheet with $230 million in cash and no debt (purely financed by SBC of $90 million to cover operating losses of $120 million).

The bad

Model has a big challenge: The people that would enjoy such a service (and pay above market price for apparel) is people that does not like fashion or apparel in the first place.

This generates enormous churn. The average customer buys only two times from them.

Via excessive performance marketing, the company was able to post a lot of growth during the pandemic and post-pandemic.

Based on that growth the company invested heavily on distribution, which added a lot of leverage.

When CAC became more expensive in 2022/23, churn started eating customers.

Valuation: EV of $145 million when adjusted for future dilution compared to revenues of $1.5 billion. If the company can operate barely above brekaeven, it is cheap. But this is improbable.