Plowing Through Pitfalls: 44 Global Agriculture Nanocaps Best Left Unnoticed

Nanocaps in Agricultural Inputs and Farm Products that are not worth the research (undercapitalized, bad management, no product).

For much of the past month, I have been systematically sifting through global companies in the Agricultural Inputs and Farm Products industries, from lowest to highest market cap, starting at a minimum of USD 1 million. You can visit the Yahoo screener here.

The immense majority of the companies reviewed are not worth more than half an hour of research. The reason is that they don’t pass the minimum suitability criteria for a long-term investor: they are undercapitalized, show significant equity losses, have no product, little revenues, or terrible margins, or compensate their managements profligately.

But because this information might be helpful for other investors, I decided to compile it here in an abbreviated list form. The companies are listed based on the line of business, and I use the Yahoo finance ticker system.

Some of these companies might be interesting to deep-value investors who know these companies have some tangible or intangible assets that are valuable. I didn’t go that deep. Please send me a note if that’s the case, and I will write a separate article.

If you are interested in a more detailed explanation of the criteria used to reject these companies, I recently wrote an article on how to recognize them.

Index

Aquaculture

Fifax AbP (FIFAX.HE)

Barramundi Group (BARRA.OL, 95Z.F)

AquaBounty Technologies (AQB)

AS PRFoods (PRF1T.TL)

NaturalShrimp (SHMP)

Pescanova S.A. (PNV.F, 0FQS.L)

New technologies and products

Plantify Foods (PTFY.V)

Save Foods (SVFD)

Agriforce Growing Systems (AGRI)

Itronics (ITRO)

Mushrooms Inc. (MSRM)

Earth Alive Clean Technologies (EAC.V)

Bee Vectoring Technologies (BEE.CN, BEVVF)

CO2 GRO (GROW.V, BLONF)

Yield10 (YTEN)

Terragen Holdings (TGH.AX)

Pond Technologies Holdings (POND.V, PNDHF)

RLF agtech (RLF.AX)

Cultivation and production

Farm Pride Products (FRM.AX)

Global Food and Ingredients (PEAS.V)

Australian Agricultural Projects (AAP.AX)

Agrogeneration (81E.F, ALAGR.PA)

Imperial Ginseng Products Ltd. (IGP.V, IGPFF)

GLG Life Tech Corporation (GLG.TO, GLGLF)

Pomifrutas S/A (FRTA3.SA)

Green Ocean Corporation (0074.KL)

PT Bakrie Sumatera Plantations (OSW.F, UNSP.JK)

Mined fertilizers

Harvest Minerals (HMI.L)

Fertoz (FTZ.AX, FTZZF)

Karnalyte Resources (KRN.TO, KRLTF)

Kropz PLC (KRPZ.L)

Replenish Nutrients Holdings (ERTH.CN, VVIVF), ex Earth Renew

Argo Living Soils (ARGO.CN, ARLSF)

Purebase (PUBC)

Emmerson PLC (EML.L)

Greenhouse

Edible Garden (EDBL)

Agtira AB (AGTIRA-B.ST, B9G.F)

Edition Ltd. (5HG.SI)

Chinese special situations

China Shenshan Orchards (BKV.SI)

Chaoda Modern Agriculture (0682.HK, CMGHF)

Origin Agritech (SEED)

Century Sunshine Group (0509.HK)

Shineco (SISI)

Aquaculture

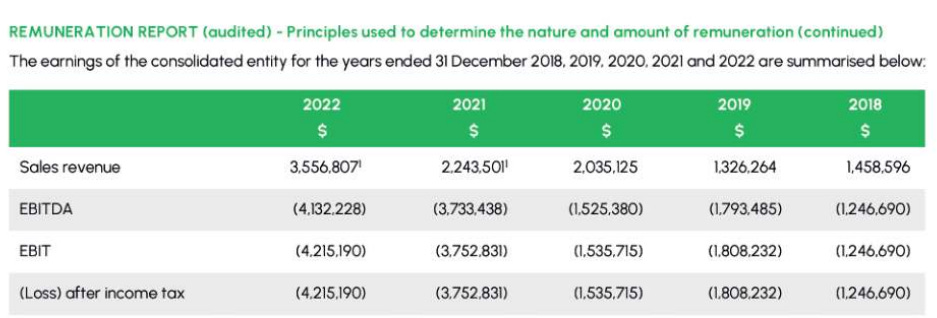

Fifax AbP (FIFAX.HE)

Fifax is a Finnish company engaged in in-house aquaculture. The company belongs to an industry that is good at destroying capital, the recirculating aquaculture systems (RAS) industry.

RAS, the hydroponic cousin of aquaculture, proposes that instead of farming fish in lakes and oceans, they should be farmed in-house in controlled environments where the water is recirculated to recycle waste and nutrients and where fish are less prone to disease. This makes intuitive sense but I have yet to find any RAS company that has not burned dozens or hundreds of millions in capital without generating more than a few million in revenues.

Fifax has already burned EUR 50 million. Their sales have not surpassed EUR 1.2 million in the past three years and are not growing, yet the company lost EUR 10 million in operations per year.

The company had to kill all its fish stock in 2022 after a disease spread in its facilities, even though the RAS system is supposed to prevent that. Fifax doubled its share count that year to raise EUR 8 million, or a year of operational losses.

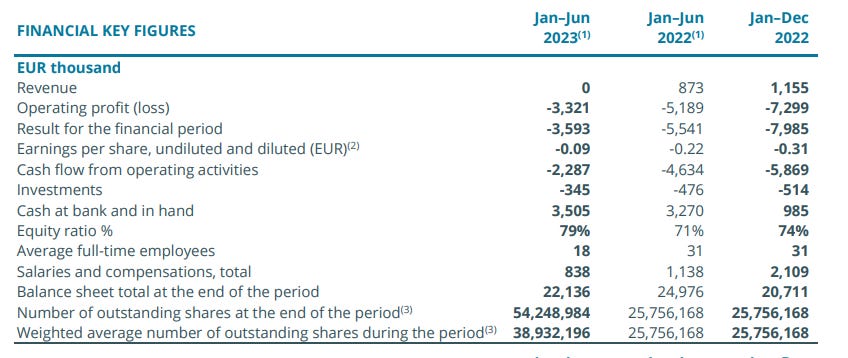

Barramundi Group (BARRA.OL, 95Z.F)

Barramundi Group is a Singaporean company with Barramundi fish farms in seawater in Brunei. It has abandoned similar projects in Singapore and Australia. The company has also engaged in adjacent hatchery and R&D areas in Singapore.

Barramundi’s equity losses reach SGD 140 million, against which it shows revenues of around SGD 35 million at operating margins of negative 50%.

Barramundi’s financial statements.

AquaBounty Technologies (AQB)

AquaBounty is an American company engaged in RAS salmon aquaculture.

AquaBounty has burned through $200 million in equity and has been listed in AIM since 2006 and in the US since 2017.

Initially, the company focused on getting approval for a GMO salmon called AquAdvantage Salmon. After its approval by the FDA, the company floated stock in the US and used the proceeds to build farms in the US and Canada.

The current facilities are not very productive or profitable. For FY22, they generated $3 million in revenues and $10 million in gross losses. However, the company plans to expand capacity in a different factory by 10x.

G&A is massive at $10 million, meaning 300% of revenues and 50% of all costs.

The company trades at a surprising P/B ratio of 0.04x.

AS PRFoods (PRF1T.TL)

AS PRFoods is an Estonian company with fishery operations across the North Sea (farming in Estonia, production and sales in Estonia and the UK, purchasing in Norway and Denmark).

The company has made a lot with little outside capital. With only EUR 21 million in shareholder contributions, PRFoods built a large business that was selling EUR 98 million at its peak in 2018, generating EUR 6 million in EBITDA.

However, since 2018, PRFoods has been on a downward road, generating EUR 12 million in sales in 1H23. I haven’t dived into the details of the downfall, but it seems that in 2018, the company had operations in Finland, Scotland, and Sweden, which it probably divested progressively. Further, a big blow to sales during the pandemic seems to have pushed the company below its breakeven turnover, which lead to higher debts and sales of assets.

NaturalShrimp (SHMP)

NaturalShrimp is an American company with RAS shrimp farms in Texas and Iowa.

NaturalShrimp has burned through $165 million in shareholders’ equity and generates almost no revenues ($237 thousand for FY23). The company’s G&A expense of $5.9 million in FY23 represented more than 50% of all operational costs and 75% of non-D&A costs.

As of June 2023, the company had $69 thousand in cash and burned $1.4 million in CFO in the 1H23 period.

Pescanova S.A. (PNV.F, 0FQS.L)

Nueva Pescanova is a very large Spanish fishing and aquaculture company with over 10 thousand employees, EUR 1 billion in assets, and operating profits.

However, the original Pescanova S.A. has been bankrupt since 2013. The company was restructured and now is called Nueva Pescanova S.L. (private).

Pescanova S.A. still exists, and its shares are traded, but it only has one asset (a 0.35% stake in Nueva Pescanova S.L., valued at around EUR 45 million), and several debts and legal liabilities for at least EUR 50 million.

Annual financial reports.

New technologies and products

Plantify Foods (PTFY.V)

Plantify Foods is an Israeli company developing plant-based foods. The company is not generating many sales, making finding information on its products difficult. It seems their main product is packaged falafels and nuggets.

Plantify Foods went public via a Canadian capital pool company (“CPC”), a form of Canadian SPAC for small companies. The merger occurred in mid-2022.

The company has consumed $7.5 million in shareholders’ equity (it was listed with about $1.5 million equity losses), and now has an equity deficit of $500 thousand as of its 1H23 report. In the 1H23 period, the company spent 300% of revenues in SG&A and close to 100% of revenues in managerial compensation.

Plantify Foods filings with Sedar.

Save Foods (SVFD)

Save Foods is an Israeli company developing a solution to decrease fruit spoilage with less fungicides. The company’s solution supposedly enhances the effect of peracetic acid (PAA), which is one of the industry’s basic treatment methods.

Save Foods G&A expenses represent five to six times all other expenses combined and close to 1500% of revenues. The company has consumed CAD 25 million in shareholders’ equity but has been unable to generate traction on the product it developed, recognizing on its latest filings that it is difficult to introduce a product into the food supply chain.

The company has also used shareholders’ equity in dubious ventures. For example, it exchanged 20% of its shares with Plantify (above) and lent CAD 1.5 million to them. This year, the company exchanged another 20% of its shares for 60% in a company that claims to have a NO2 reduction bacteria, but that has no meaningful assets.

Agriforce Growing Systems (AGRI)

Agriforce is an American consultant that provides a seemingly too-broad line of services, including expertise in facility lighting design, artificial intelligence and automation, fertigation and genetics. They are developing a new method of in-house cultivation called agriFORCE.

The company has lost $40 million in shareholders equity, and generates no revenues. Wages, consulting, and professional fees make up half of the operating expenses. Most of the company’s assets are intangibles.

Agriforce Growing Systems financial results.

Itronics (ITRO)

Itronics is an American company engaged in technologies for fertilization, mining tailings treatment, and processing of recycled PCB boards.

I have not been able to find financial statements for the company.

Mushrooms Inc. (MSRM)

Mushroom is an American company developing applications for mycelium, without a specific industry focus (healthcare, fashion, construction, packaging).

Their webpage does not transmit the idea that they have any meaningful business. I haven’t found their financial statements but WSJ shows they have negative equity.

Earth Alive Clean Technologies (EAC.V)

Earth Alive Clean Technologies is a Canadian company developing microbes used for increasing soil fertility, industrial cleaning, and increasing the resistance of dirt roads.

Earth Alive has used CAD 25 million in shareholders’ equity. The company has not been able to grow sales above the CAD 3 million yearly mark since 2019. G&A represents the largest expense bucket, above CoGS and larger than revenues. Executive pay makes up 50% of G&A expenses.

Earth Alive Clean Technologies Sedar filings.

Bee Vectoring Technologies (BEE.CN, BEVVF)

Bee Vectoring Technologies is a Canadian company developing a method for applying fungicides via microbes and bees.

The company initially went public by focusing on using bees for pollination and applying crop control products. A few years later, they refocused on a specific microbe strain that they claim generates 30% higher yields in berry cultivations.

As of FY23, the company has lost CAD 34 million in shareholders’ equity but has been unable to generate more than CAD 1 million in yearly sales. G&A expenses and share-based compensation are more than 300% of sales and represent more than two-thirds of all expenses.

Bee Vectoring Technologies SEDAR filings.

CO2 GRO (GROW.V, BLONF)

CO2 GRO is a Canadian company developing an aqueous solution injected with CO2 that supposedly provides plants with better access to CO2 than atmospheric replenishment.

CO2 GRO has spent CAD 23.5 million in shareholders equity. The company generates negligible revenues. The majority of the expenses belong to managerial compensation and consulting fees. Listing and investor relation costs represent a larger expense than R&D.

Yield10 (YTEN)

Yield10 is an American company engaged in the cultivation of Camelina for use as a biofuel. A few years before, the company was called Metabolix, and focused in developing biopolymers.

As of FY22, Yield10 has burned through $400 million in shareholders equity and generates no revenue. G&A represents half of the expenses.

Terragen Holdings (TGH.AX)

Terragen Holdings is an Australian company developing microbial feed supplements for calves and cows.

After burning AUD 40 million of equity, the company found that the product (called MYLO) is challenging to sell because it has a very short shelf-life. Terragen has not been able to grow sales since 2019 (stagnant at around AUD 3 million and generating operating losses of AUD 4 to 6 million). The company's CEO resigned in June and was replaced by the CFO.

After raising an additional AUD 4.5 million in equity, the company will focus on developing a dry formulation for MYLO. Unfortunately, it has less than a year of cash on hand.

Terragen ASX announcements (look for FY23 annual report).

Pond Technologies Holdings (POND.V, PNDHF)

Pond Technologies Holdings is a Canadian company developing bioreactors and genetically modified algae to treat common pollutants and convert them to useful materials.

The company burned through CAD 50 million in shareholder’s equity and has an equity deficit of CAD 3.5 million. Pond Technologies has had stagnant sales of CAD 5 million a year for the past five years, with 100% negative operating margins,

RLF Agtech (RLF.AX)

RLF Agtech is an Australian company developing an unclear nutrient delivery method called the Proton System in China.

The company claims to generate AUD 10 million in revenues, but revenues have been stagnant since 2018, generating a yearly loss of around AUD 3 million. Director fees and management compensation of AUD 2 million make 20% of sales.

Cultivation and production

Farm Pride Products (FRM.AX)

Farm Pride Products is an Australian company that purchases, packs and markets eggs.

The business seems relatively simple, but the company shows equity losses of AUD 30 million, and generates losses of AUD 9 million on revenues of AUD 82 million.

Farm Pride Producs investor documents.

Global Food and Ingredients (PEAS.V)

Global Food and Ingredients Ltd. is a Canadian company with operations in Canada and the US that sources, processes, and commercializes peas, lentils, and other types of legumes and pulses.

GFI is relatively young, listed in June 2022. This means it is a little early to judge its operations fully, so I did not concentrate on that area. However, there are specific managerial aspects that make me reject this company.

The company burned CAD 10 out of the CAD 14 million raised on its IPO in the first year of operations.

G&A is the largest expense category outside of CoGS and represented more than 100% of gross profits in FY23 and FY22.

Further, 65% of G&A went to compensation and consulting fees. 30% of G&A is compensation to key managers ($1.5 million in FY23, or 10% of the IPO proceeds).

Some shareholders have lent to the company at very high interest rates (1% monthly and 15% yearly in the two loans disclosed).

Australian Agricultural Projects (AAP.AX)

Australian Agricultural Projects is an Australian company managing 500 hectares of olive oil trees in Victoria.

AAP has burned through AUD 18 million in shareholders' equity. It has generated business for around AUD 2.5 million for the past three years (mostly managerial fees), at a consistent loss of AUD 500 thousand.

The company is relatively leveraged with AUD 5.4 million in borrowings, maturing in the next two years. These loans were mostly provided by shareholders at high rates (RBA + 5% with an 8% floor).

Agrogeneration (81E.F, ALAGR.PA)

Agrogeneration is a Ukrainian wheat farmer, with most of its assets located in Kharkiv, one of the fronts of the Russo-Ukrainian war.

Until the war is resolved, this company is very difficult to evaluate, but the company generally posted losses even before the war.

Agrogeneration annual reports.

Imperial Ginseng Products Ltd. (IGP.V, IGPFF)

Canadian cultivator of ginseng products. The company is being wound up, and could be considered a net-net close to distribution.

Imperial has sold its businesses and, as of June 2023, had close to CAD 17 million in net cash. The potential distribution has been mostly arbitraged away as the company trades at a market cap of CAD 15 million today.

Further, how the wind-up dividend would be treated under Canadian Tax is unclear. Canada applies a 25% withholding tax to non-residents (PWC report), but on the other hand, dividends that are returns of capital should not be taxed (one source). Given that Imperial Ginseng has deficit on the results account, I guess the dividend is a return of capital, but I’m no tax expert.

GLG Life Tech Corporation (GLG.TO, GLGLF)

GLG Life Tech Corp. is a Canadian company developing stevia and monk fruit extracts for sweeteners.

Despite calling themselves the world’s leading sustainable and vertically integrated producer of zero-calorie natural sweeteners, they are bankrupt, with CAD 180 million in equity deficit, after burning CAD 440 million in shareholder’s equity.

The company never generated financial operating income nor more than CAD 15 million in revenues.

Pomifrutas S/A (FRTA3.SA)

Pomifrutas is a Brazilian company cultivating apples in Brazil’s southeast (Santa Catarina).

The company has invested and lost BRL 220 million, leaving a deficit of BRL 74 million. At the peak (2020) Pomifrutas generated BRL 15 million in revenue, at an operating loss of BRL 1 million. Today it generates BRL 7 million in revenue at an operating loss of BRL 4 million.

Green Ocean Corporation (0074.KL)

Green Ocean Corporation is a Malaysian company engaged in palm oil crushing, refining and trading, without plantation operations.

The company has been in operation since 2005, has a loss in the equity account of $16 million and generated losses in FY22 and FY23 despite the palm oil market rallying for most of 2022.

Green Ocean Corp. documents Bursa Malaysia

PT Bakrie Sumatera Plantations (OSW.F, UNSP.JK)

PT Barkie Sumatera Plantations is an Indonesian palm oil cultivator. The company shows earnings in 2021 and 2022 because of the palm oil bull market, but besides those years, it has lost money consistently.

The company has a deficit of IDR 6 trillion (close to $400 million).

PT Bakrie Sumatera Plantations investors site.

Mined fertilizers

Harvest Minerals (HMI.L)

Harvest Minerals is a Brazilian company developing a rock dust fertilizer mine.

Rock dust is a low-concentration fertilizer (3% P2O5, 3% KO2) that provides the soil with other required minerals (Ca, Mg, Si). It is being recognized as a potential complement for soil management and is recognized in long-term Brazilian government plans (Brasil 2050 agriculture strategic plan, under remineralizadores). These are relatively cheap to obtain, usually as a by-product of other forms of mining, but its concentrations are low, and they become expensive to transport.

Harvest Minerals arrived at this business after several failed tin and potash mining attempts in Brazil’s Northeast. In total, the company has burned through GBP 36 million in shareholders’ equity.

The company’s directors have been making more than GBP 500 thousand annually since at least 2017, even though they hold office in several other companies.

I will probably revisit Harvest Minerals because the company is selling the product and claims to have generated as much as GBP 2.8 million in CFO for FY22. However, the current lack of profitability, equity losses and expensive management deter me from further research.

Harvest Minerals annual reports.

Fertoz (FTZ.AX, FTZZF)

Fertoz is an American company with several North American phosphate mining projects. The company has grown substantially in the past five years but at the cost of generating ever larger losses, even on an EBITDA basis.

The company currently trades below book value but has less than a year of cash, and has burned through AUD 26M of shareholder equity.

Fertoz financial statements

Karnalyte Resources (KRN.TO, KRLTF)

Karnalyte is a Canadian company developing a potash mine in Wynyard, Saskatchewan. Saskatchewan produces 30% of the global potash supply, singlehandedly making Canada the largest product exporter. Karnalyte plans to compete with giants like BHP Billiton and Mosaic in this area.

Potash mines are massive endeavors, with BHP Billiton investing $14 billion in their Jensen project close to Wynyard.

Karnalyte invested more than CAD 135 million in exploration and equipment in their mine project. By 2013 and 2014, the commodity boom was over, the company’s stock had collapsed, and Karnalyte recognized impairments for over CAD 100 million on those assets.

The problem with Karnalyte is not the impairment or the fact that the company continues paying CAD 600 to 700 thousand a year to managers who do not have much to manage, but rather that they expect the first stage of their mine to cost CAD 789 million in CAPEX. With a market cap of CAD 11 million, it seems difficult for Karnalyte to pull that kind of financing.

Kropz PLC (KRPZ.L)

Kropz is a South African company developing a potash mine in South Africa, with a project to develop another one in the Democratic Republic of Congo.

Kropz has generated $116 million in equity losses but is currently producing from its Elandfostein project. As of 1H23, production is still unprofitable on a gross basis.

The company’s cash situation is precarious, and its largest shareholder, the listed African Rainbow Capital (AIL.JO), has provided the company with equity lines and credit. ARC owns over 80% of the company’s capital and has lent over $35 million to Kropz.

It is unclear how much more ARC is willing to invest in Kropz, as the mine already represents the third largest investment in the fund, with a participation of 12%.

Replenish Nutrients Holdings (ERTH.CN, VVIVF), ex Earth Renew

Replenish Nutrients is a Canadian fertilizer manufacturer and commercialize with facilities in Alberta. The company produces a mix of potash with sulfur and compost in microgranulated form.

Before that, it was known as Earth Renew, and operated a gas turbine plus a pelleted fertilizer facility. This 2019 MD&A phrase made me laugh: “EarthRenew’s competitive advantage rests in its unique ability to convert natural gas to electricity from an industrial-sized gas turbine”. Haha, what a unique ability, convert natural gas to electricity via a turbine.

Replenish Nutrients post accumulated deficits of CAD 22 million as of FY22, against which it shows growing revenues of close to CAD 18 million, albeit at also increasing operational losses of close to CAD 4 million.

G&A represents the majority of the non D&A operational expenses, and managerial compensation is more than half G&A, at CAD 1.4 million.

Replenish Nutrients Holdings SEDAR filings.

Argo Living Soils (ARGO.CN, ARLSF)

Argo Living Soils is a Canadian company that is setting up a compost processing facility.

Argo has not produced significant losses, since it IPOed in 2021 and has raised less than CAD 1.5 million from the market. However, the company lacks any meaningful operations so far.

Argo Living Soils SEDAR filings.

Purebase (PUBC)

Purebase is an American company developing a mine of kaolin. They are trying to market kaolin as a crop protection product (it is sprayed and protects certain crops from the sun radiation).

The company has equity losses of $60 million, an equity deficit of $1 million, and does not generate any meaningful revenues.

Emmerson PLC (EML.L)

Emmerson PLC is a company developing a potash mine project in Morocco.

The project is in the exploration stage, but the company spends more on compensation than exploration. In FY22, the company paid $2.5 million in administrative expenses, $600 thousand of which were director fees alone, and only spent $5 million in exploration.

In total, the company has spent $13 million of equity, and capitalized $18 million in exploration costs. This comes to about $1.4 spent in exploration for every $1 spent in management.

Emmerson PLC corporate documents.

Greenhouse

Edible Garden (EDBL)

Edible Garden is an American company engaged in greenhouse cultivation of vegetables.

The company has generated $26 million in losses to shareholders’ equity. Edible Garden generates sales ($11.5 million in FY22), but at break-even gross margins and has an SG&A structure that is close to 100% of sales and growing.

Edible Garden filings with the SEC.

Agtira AB (AGTIRA-B.ST, B9G.F)

Agtira AB is a Swedish company that operates greenhouses just outside of supermarkets.

Agtira has consumed SEK 66 million in shareholders’ equity. Although the company generates sales, and these are growing (SEK 25 million in FY22 vs SEK 12 million in FY21), the company’s net loss margin is close to 100% and not improving.

Agtira AB’s financial documents (in Swedish).

Edition Ltd. (5HG.SI)

Edition is a Singaporean company developing a small 1-hectare greenhouse project in Singapore, intending to grow it to 6 hectares.

Edition has consumed SGD 35 million in shareholders’ capital and generates less than SGD 300 thousand in revenues, costing more than SGD 3.5 million per year.

Key managerial compensation represents one-sixth of all costs and one-third of all employee costs.

Chinese special situations

China Shenshan Orchards (BKV.SI)

China Shenshan Orchards is a Chinese kiwi manufacturer listed in Singapore.

The company IPOed in 2008 as Trump Dragon Distillers and quickly acquired a large baijiu distillery called Dukang Distillers (杜康). During the 2010s, the baijiu industry had a terrible downturn in China, and Dukang suffered losses for years.

Strangely, in 2018, the company’s largest shareholder decided to exchange a malfunctioning distiller for a profitable kiwi cultivation company. After the exchange was consummated in 2021, Shenshan Orchards was born.

Today, Shenshan trades at a fraction of its RMB 1 billion book value (P/B ratio of 0.04x). Further, the company boasts a net profit margin of 60%, and topline growth of 50%+.

How can a company trade at 0.5 times earnings and 0.04 times book? People don’t believe the numbers are real, and I don’t either. It seems very difficult for a fruit cultivation business to reach 60% net margins consistently for years, which Shenshan claims. More difficult even is for its owner to exchange it for a problematic distiller gratuitously.

When things seem too good to be true, they probably are.

China Shenshan Orchard Investor Relations website.

Chaoda Modern Agriculture (0682.HK, CMGHF)

Chaoda is a Chinese agriculture group cultivating vegetables in Mainland China for internal consumption and exports.

It is a gigantic company, only trading as a nano cap because of its massive restructuring and history of fraud allegations.

For FY23, Chaoda shows an equity of RMB 209 million, which makes its stock trade at a fraction of book value. However, the reserve accounts show Chaoda has already destroyed RMB 6 billion of shareholders equity.

Still today, the company has a massive scale for its market cap, with close to RMB 90 million in sales, albeit at close to RMB 4 million in operating losses.

Given the discount to book value, some investors might consider it a good deep-value candidate. I decided to ignore Chaoda given the already complex Chinese governance issues, plus the history of capital destruction.

Origin Agritech (SEED)

Origin Agritech is a Chinese GMO seed developer listed in the US.

As of March 2023, Origin Agritech has an equity deficit of RMB 141 million, after accumulated losses of RMB 657 million. The company has RMB 14 million in cash against RMB 137 million in current borrowings.

For FY20 and FY21, Origin Agritech’s G&A expenses represented the largest expense component, more than 100% of revenues. As of 1H23, the situation is a little better, with G&A representing 50% of gross profits.

Century Sunshine Group (0509.HK)

Century Sunshine is a Chinese company listed in Hong Kong that manufactures organic fertilizers in China’s North East.

The company is undergoing a debt restructuring process that puts substantial doubts on the value of the equity claims. Further, Century Sunshine’s sales fell from HKD 4.3 billion in FY19 to RMB 500 million in FY22, generating large operational and impairment losses.

Century Sunshine annual reports.

Shineco (SISI)

Shineco is a Chinese firm listed in the US that has changed businesses many times. It has been engaged in herbal medicines, tea cultivation, medical diagnostic products, and air freight forwarding and has now acquired a cocoon silk business. The company has burnt at least $30 million in shareholders’ equity.

Today, Shineco boasts a supposedly healthy balance sheet, with $30 million in equity, compared to a market cap of ‘only’ $5 million. It is not uncommon for Chinese micro and nano caps to trade at extremely low P/B ratios. The problem is that these companies tend to burn that capital cushion quickly, and it’s not always clear that the cushion exists.

For example, in FY23, SISI spent $9 million in G&A despite generating no consolidated revenues (and discontinued operations generating only $2.5 million in revenues). It burned $5.4 million in CFO for the past two years and has made acquisitions for $11 million in FY23, over which investors have little knowledge.