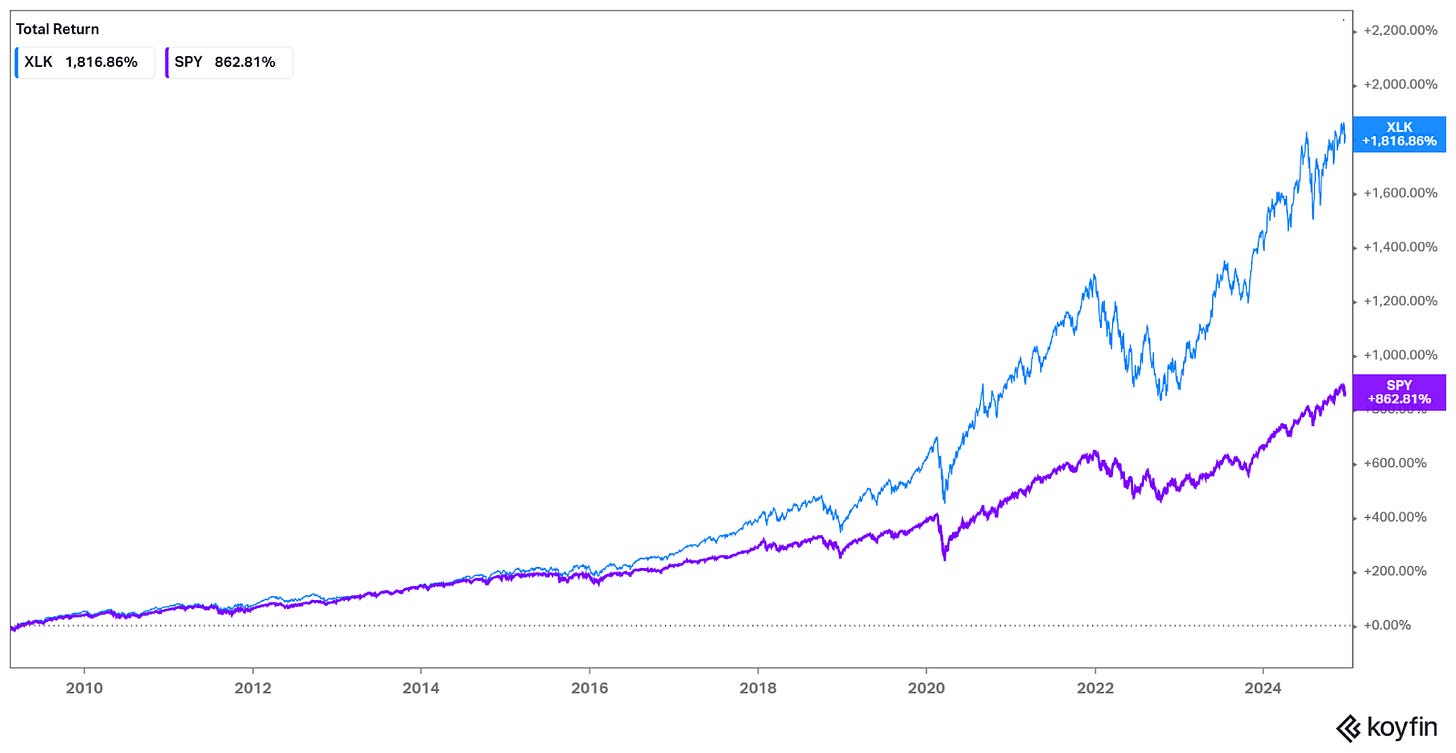

IT has been the best-performing sector in the global economy for the past 25 years, leaving all other sectors in the dust, particularly since the Great Financial Crisis bottomed in 2009 and even more since COVID accelerated virtualization. IT is also the canon growth sector, with most of the hyper-compounders of this century.

This is not a coincidence. Many factors explain the overperformance of the IT Sector. The 21st century has been the application period of the IT industrial and technological revolution, with IT permeating every aspect of production and consumption. The sector also has growth-enhancing characteristics like low(er) capital requirements, low(er) marginal costs, and low(er) distribution costs and barriers. In the childposter example, a software-based company like Facebook (now Meta) can disrupt a fundamental aspect of human life bootstrapped from a single location to the whole globe in a matter of years.

Therefore, IT is definitely full of opportunity. However, it also requires care. Valuations are generally high, as the sector’s positive characteristics are well known. Some of its growth-enhancing characteristics also make it highly competitive (for example, low distribution and capital costs make for low barriers to entry). For each success story, there are also many companies in the tech cemetery that never took off. Finally, the performance of the past 30 years may not be replicable in the future as the IT revolution matures.

The IT sector is also highly diverse. It includes companies from consumer-focused software (like Meta or Alphabet/Google), to the manufacturers of the chips that power the IT revolution in all production areas (like the chip foundry TSMC). Each subsector, industry, and subindustry has its own competitive dynamics, stage of maturity, and current valuation.

This article provides an overview of the industries, sub-industries, and companies in the IT sector. It includes a simple schematic of each industry's location in the value chain, an explanation of their competitive dynamics and internal subdivisions, and lists of their main companies. It also includes a ‘heat map’ comparing aggregate average fundamental figures like profitability, growth, and valuation, in an effort to uncover potentially undervalued areas of the market.

Index

History of the IT revolution

Overview of the IT sector

Basic economics of IT businesses

Industry fundamentals heatmap

Overview of each IT industry

History of the IT revolution

To understand the world of IT today, we need to put the sector in its historical context. IT has been the driver of the last technological and industrial revolution, which has lasted for almost 80 years now. Understanding where that technological revolution is today may help us understand if the sector will perform as well in the future or not and which sub-industries are more promising.

The technological origins of the IT revolution

Put very simply, IT is the industry of computers and their programs (computers understood very vaguely as anything that ‘computes,’ from the chip on your digital watch to the PC, to the mobile phone and the super-clusters running the latest AI models). More specifically, IT stands for information technology and, therefore, includes products and services whose main task is handling information.

IT predates computers: people organized and moved information on clay tablets in antiquity, then paper, books, the telegraph, etc. However, IT as a technological revolution was born with the computer (again, vaguely defined, not just PCs): a machine that could represent information in a digital format (numbers) and that could process that information using electricity, therefore gaining extreme speed.

The first computers were invented thousands of years ago as calculators, like the abacus or the compass. The first modern computers were built in the early 20th century, especially during and after WWII, to do calculations for the war effort (mainly in ballistics). These first computers were electromechanical, with moving parts, and occupied entire rooms.

The second technological breakthrough of the IT revolution was the transistor, which allowed the same operations to be performed without moving parts, purely with electricity. This breakthrough opened the floodgates to speed, miniaturization, and cost improvements. Today, a cheap mobile phone can perform several billion numeric operations per second.

The infrastructure of the IT revolution

The IT revolution (computers and the transistor) began quite slowly in the 1930s and 1950s and then accelerated in each consecutive decade until today. A technological revolution has two vectors of attack: technological improvement and societal adaptation.

On the one hand, technology is incrementally improving and diversifying. For IT, this means ever-diminishing cost per computation (the famous Moore’s Law): cheaper, faster, and more reliable chips. It also means better ways to network computers (ethernet, internet, communication protocols, wireless networks) and better ways to interface with them (from punched cards to programable computers, graphical interfaces, the keyboard, the PC, the mobile phone, etc.).

As technology improves, more and more aspects of life can be transformed by it. This is where the second vector, societal adaptation, moves forward. People need to learn how to use the technology, so training is needed (for example, opening Computer Science majors in most universities or teaching a secretary how to use Excel). For information to be stored and modified, processes need standardization, and institutions need to model themselves to serve the computer (this process started much earlier than the IT revolution, with scientific management and bureaucracies). Government regulations must change to allow telecom companies to build the internet infrastructure.

The application of the IT revolution

As computers became cheaper, easier to use, and more connected, we could use them to change how we do things in all areas of life. This is where the application of the technology takes place. This includes creating programs specialized for certain tasks (Word for processing text, Chrome for visiting the internet, or Uber for asking for a taxi) and adapting the way we do things to include computers (like submitting work via email or asking for a taxi using Uber and not just raising your hand on the sidewalk).

We are currently in the application stage of the IT revolution, which is far from finished. Many things are still done manually (like calling for a doctor’s appointment), and even when things are done digitally, they may not fully utilize the power of information management (for example, by inputting the appointment you make on the phone into an Excel spreadsheet that is not connected to the internet).

Further, because the infrastructure layer is so incredibly advanced (the internet is ubiquitous, everyone knows how to use a computer, and computing has been fully commoditized and quantized in the cloud), the application stage is accelerating to the fastest ever. This is why today, an app can become an overnight success with millions of users in months. It is standing on top of a society that has already ingrained IT.

Is AI the last stage of the IT revolution?

Before AI, many tech theorists considered the cloud the last stage of the IT revolution because the infrastructure layer could not be improved further. With the cloud, centralized computing and storage power can be accessed from anywhere, so you can access a supercomputer and all of the Internet from your phone. The only remaining tasks are applications: moving data and programs to the cloud so that everything is finally connected and machine learning techniques can be applied to that data.

AI (or LLMs, more specifically) has definitely changed that view. We may no longer need to interact with phones or PCs, requiring only to speak (or even telepathically communicate) with global computers. We may not even need to move information around (for example, sending emails and having meetings), with AI agents moving all of that communication work to the background.

Further, AI could be the spark of the next technological revolution(s). The previous revolution (mass production) generated the conditions for the IT revolution: standardization and bureaucratization brought by scientific management at the societal infra level and a sufficient level of manufacturing quality to produce the semiconductors and electronics behind digitalization at the tech level. Could AI help us reach the scientific breakthroughs behind clean and cheap energy (fusion), automation of physical work (robotics), and the manipulation of life (biotech)? These are nascent and slowly moving technologies (compared to IT in its current stage), signaling a nascent tech revolution.

Overview of the IT sector

As mentioned in the intro, IT goes from consumer apps like Instagram to chemical manufacturers that purify the silicon that ends up in chips. IT as a technology (not an economic sector) is also embedded in almost any productive process. Many companies not classified as IT are nonetheless absolutely reliant on IT (for example, Uber is considered an Industrial company, but without phones, it would not exist). For that reason, it pays to paint a picture of the sector, with all its industries and sub-industries, plus the industries heavily dependent on the sector but belonging to another.

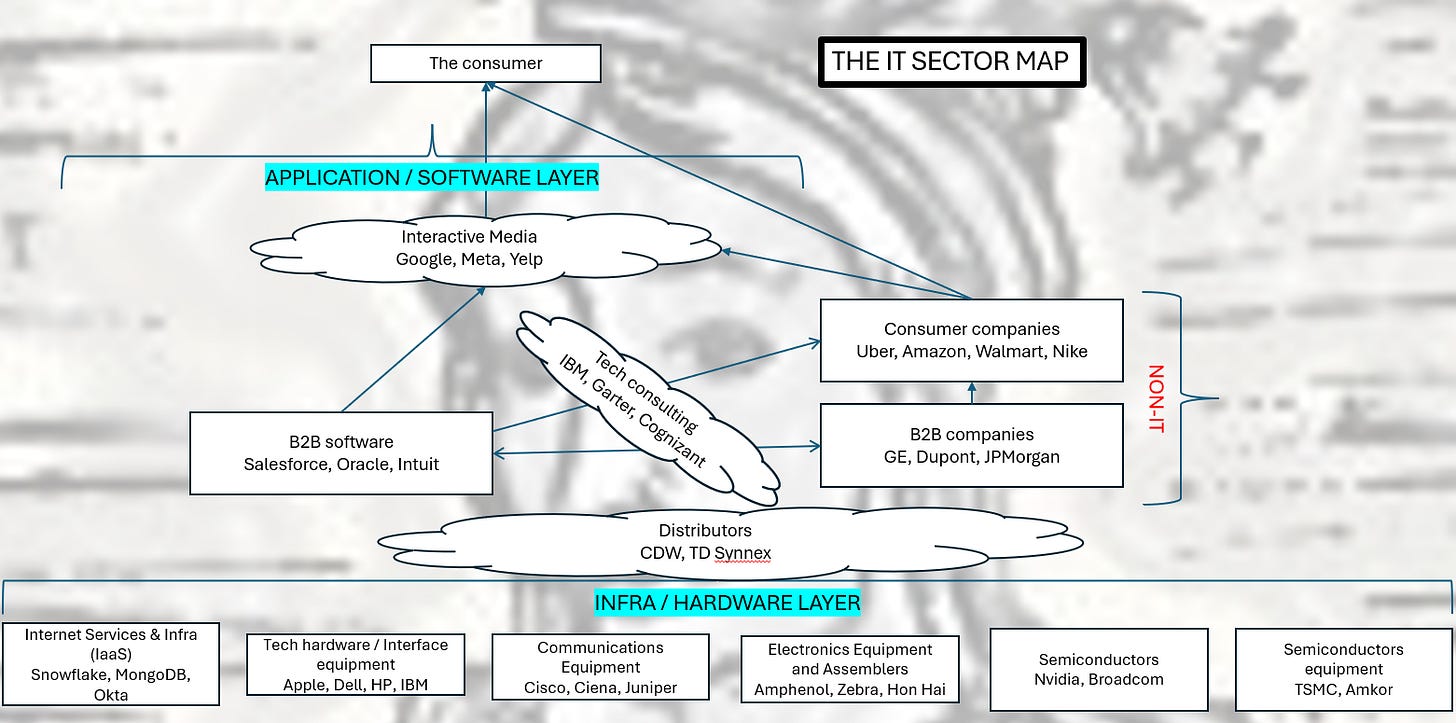

The IT sector is commonly divided into 12 sub-industries, depending on the type of product or service offered. I have mostly followed that conventional classification, with some variations that better help me understand the market. The picture below offers a map to help you understand how each industry is positioned in relation to the consumer and other industries.

The first segmentation is the application/infrastructure layer. On the application side, we have industries whose products and services are created to solve a specific human or institutional problem, need, or desire. These include ‘finding information’ (Google) or ‘managing the company’s accounting’ (Intuit). On the infrastructure side, we find products and services (mostly hardware but also some software) that are less specific tools, like a PC, which can be used for anything, or semiconductors in general, or the software that is used to build other software (like a database manager). We could also call this divide the software/hardware segmentation, as all industries on the application side deal with software and the others mostly with hardware. Vertically, we can also read the chart as going from closer to consumers to farther away in the value chain on both sides of the software/hardware segmentation.

Starting from the top, we find the Interactive Media industry. This industry could also be called the ‘Consumer Web’ as it includes all social media, search, video streaming, forums, and shopping sites. It is a cloud between the consumer and the non-IT consumer companies because Interactive Media sells advertising (basically access to consumer attention).

Then, we find the non-IT industries, both consumer-focused and B2B. Some of these companies (like Uber or Amazon) could be considered IT companies because their products rely heavily on IT. However, they are correctly classified outside of IT because their business is not selling an IT product. If any company using IT were considered IT, everything would be IT, because IT is a basic infrastructural layer of society. In the same way that we don’t think of a steel company that uses electricity as ‘an electric company’, we cannot consider everything that uses IT as an IT company.

Moving back to software/applications, the B2B Software industry includes most companies developing software for other businesses, covering functions from HR to supply chain, finances, design, and work collaboration. All companies purchase at least some basic business software (Windows and Excel), and the trend is toward increasing digitalization (as part of the application wave discussed above).

In many cases, non-IT companies need help in buying IT, whether it is software or hardware. They do not know how to improve their processes with IT, how to implement the programs, and what hardware is needed. This is where the cloud of Tech Consulting and Distributors plays a middle-man role.

The Tech Consulting industry designs and builds software and systems for other companies. They are akin to the masons (much less so architects) of the business IT world. Therefore, they sometimes act as gatekeepers between B2B Software and non-IT companies. The Distributors deal more with hardware products (although they sometimes sell software too). They are similar to wholesalers of hardware, buying in large quantities from the manufacturers and then selling in smaller batches to businesses. They do not advise so much on what to buy but may still work as gatekeepers in some cases.

Then, we move to the infrastructure and hardware layer.

The only software industry in this subsector is the Internet Services & Infrastructure industry. These companies sell software that becomes part of other software. They are more upstream in the software value chain. One example is MongoDB, which offers database-managing software. Databases are not very useful per se for any specific application, but they are a key component of many more specific applications.

Continuing from downstream to upstream, we have the Tech Hardware industry. This includes all of the equipment we use to interface with IT (PCs, laptops, phones, tablets, plus their peripherals like keyboards, webcams, etc.). It also includes large computing equipment bought by companies for their data centers (called High Performance Compute or HPC) and storage devices, among others.

Then we have the Communications Equipment industry, which comprises networking equipment companies. These companies design and manufacture the routers and servers that are the backbone of the Internet and other networks, such as the cellular network.

Finally, on the device side, we have the Electronics Equipment (and Assemblers) industry. This is a catch-all for electronic components that go inside hardware equipment, industry-specific hardware (like computer vision readers), and the companies that manufacture for the Tech Hardware and Communications Equipment industries (the Assemblers, like Foxxcon for the iPhone).

Finally, we get to the most basic and infrastructural industries. All of IT is based on Semiconductors, which power not only all of the equipment above but also products in many other industries, like cars or industrial equipment. These chips range from the Intel CPU in a laptop to the NVIDIA GPUs running the LLMs, sensors in cars, and chips that make Wi-Fi networking possible. The Semiconductor industry mainly includes chip designers who do not manufacture chips. Manufacturing is the role of the Semiconductor Equipment industry. This industry includes the entire supply chain for semis, except for the design. This goes from producing materials (like silicon purified to the billionth atom) to wafer production, testing, packaging, and integrated manufacturing (foundry).

Historical performance of the industries

Several providers construct indices based on the above classification (the most important being S&P). I am not able to reproduce the indices here as the data is private, but I can share some conclusions on historical returns.

The software segments have produced much higher returns since the 2000s in any specific time period afterward. This includes Interactive Media, B2B Software, and Infra Software. The reason is that the 2000s/20s have been the application period and, therefore, a more software-leaning period.

Most hardware industries have performed much worse than software, lagging the S&P500. The reason (in my opinion) is that hardware has been slower to improve as the infrastructural period ended and the application period started. With slower technological improvement and more mature markets, competition has eaten the returns of these industries. This is in contrast to before the 2000s, when the infrastructure companies (mainframes like IBM, systems software like Microsoft, and communications equipment like Cisco) were the best performers.

There are three exceptions: Semiconductors and Semiconductor Equipment, which have favored from continuous tech improvement and have also been “applied” to other industries; and Tech Hardware, although I think this latter industry index is heavily skewed by having Apple as one member.

Basic economics of IT businesses

Although each industry is different (and we will overview each in a section below), most IT industries share some characteristics regarding their competition and economics.

First, most IT industries have high fixed costs and low marginal costs (negligible in the case of software), leading to high operating leverage and the need for scale economies to become profitable. Thus, it is unsurprising for an IT company to show impressive unit economics after passing a certain fixed-cost coverage threshold.

A second important factor is the lack of barriers to competition. Despite being involved in tech, most IT industries do not enjoy strong IP protection, and some industries' capital requirements are very low. Even in the most IP-heavy industries (like Semiconductor Equipment), companies that do not maintain a technological edge will be commoditized.

This leads to either the search for technological dominance, which leads to heavy R&D investment, or the search for other types of barriers to competition, like network effects and high switching costs. Maybe because of this, we find that in many IT areas (particularly software), plenty of companies that should compete with each other instead follow a niche strategy of serving a single subsegment of the market and, therefore, avoid competition that would be profit-destroying based on classical economics analysis. Another factor leading to high margins despite classical market protection is growth. In a growing market, competition is lower because all players can increase their market without bumping so much into each other. It is when a market matures that competition increases substantially.

Most of these aspects vary between the software/hardware layer. In software, IP protection is even lower than in hardware, where the technological edge can prove much more important. Software also has almost negligible marginal costs (compared to some variable costs for hardware), leading to even more operational leverage. Hardware also tends to be more cyclical as it is affected by business investment demand (instead of the consumer as much) and does not work with long-term contracts (as is more common in B2B software).

IT sector fundamentals heatmap

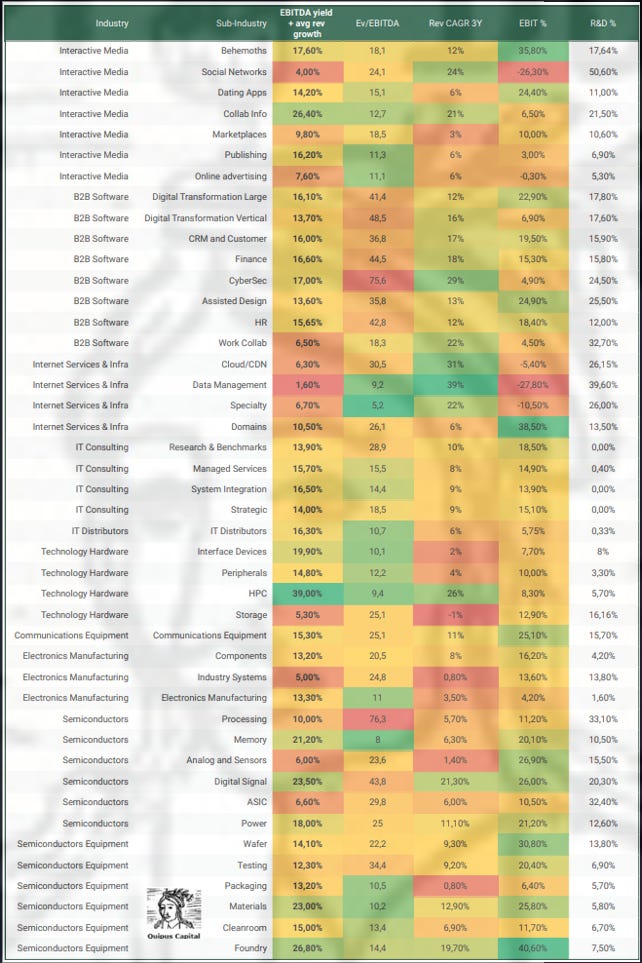

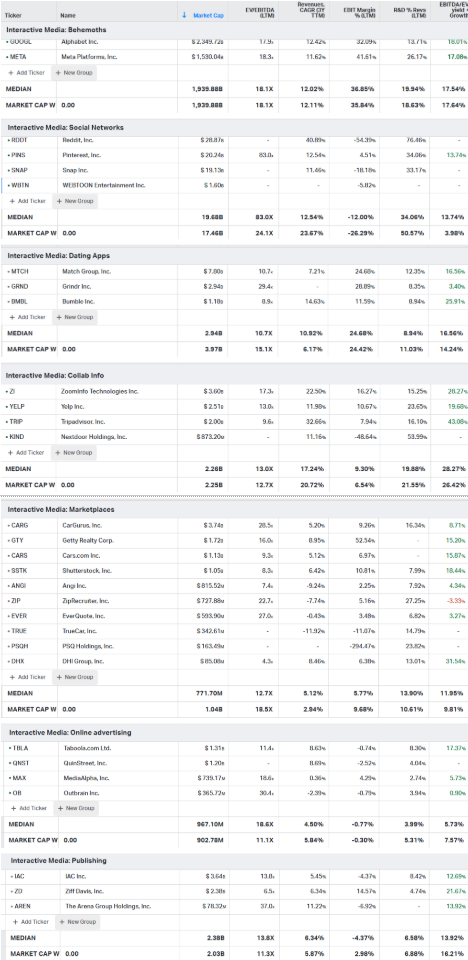

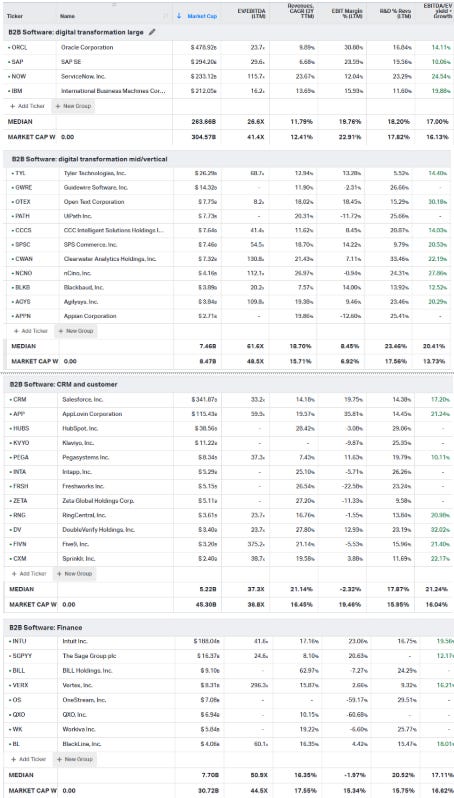

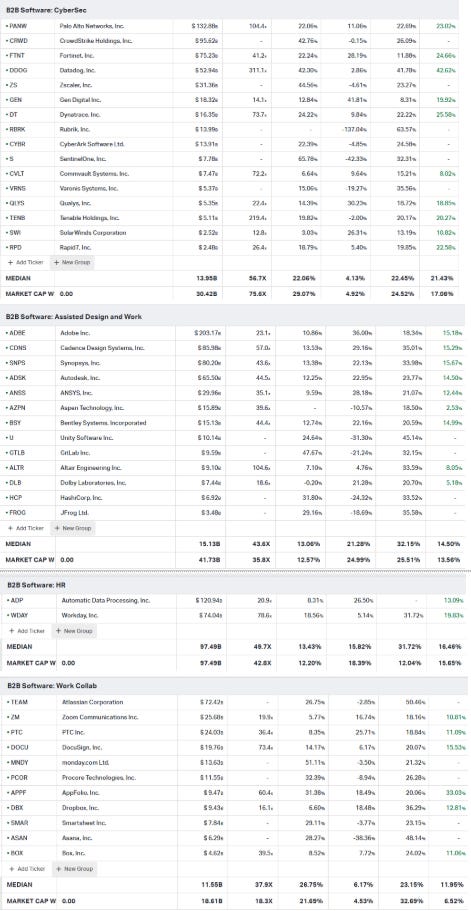

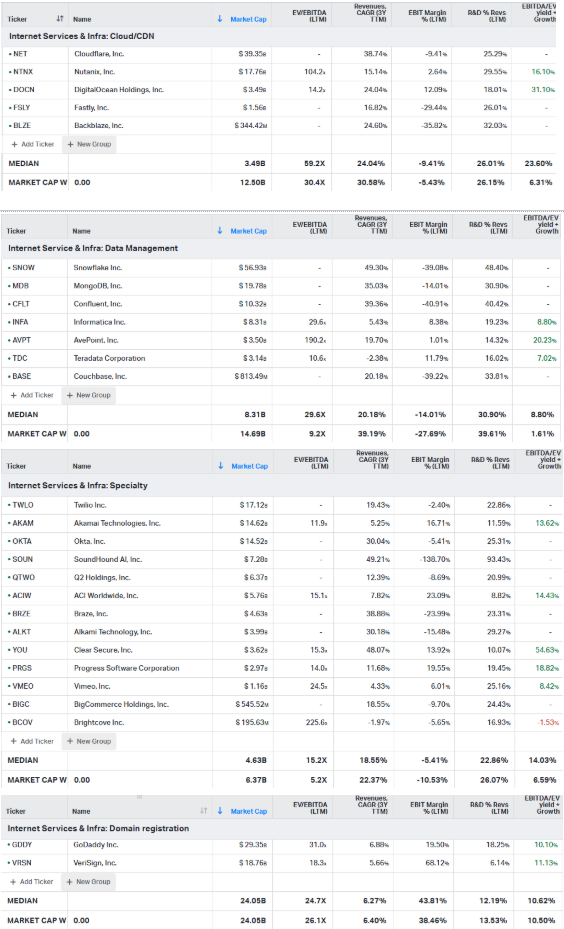

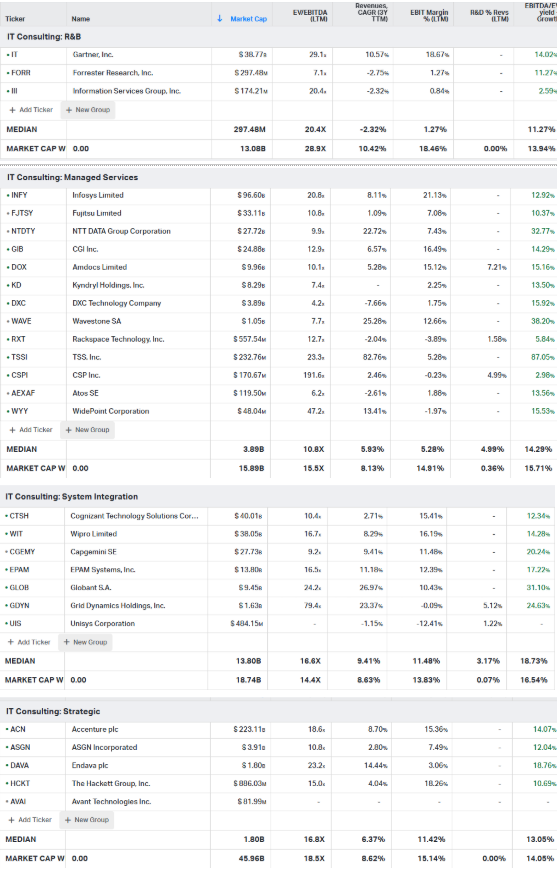

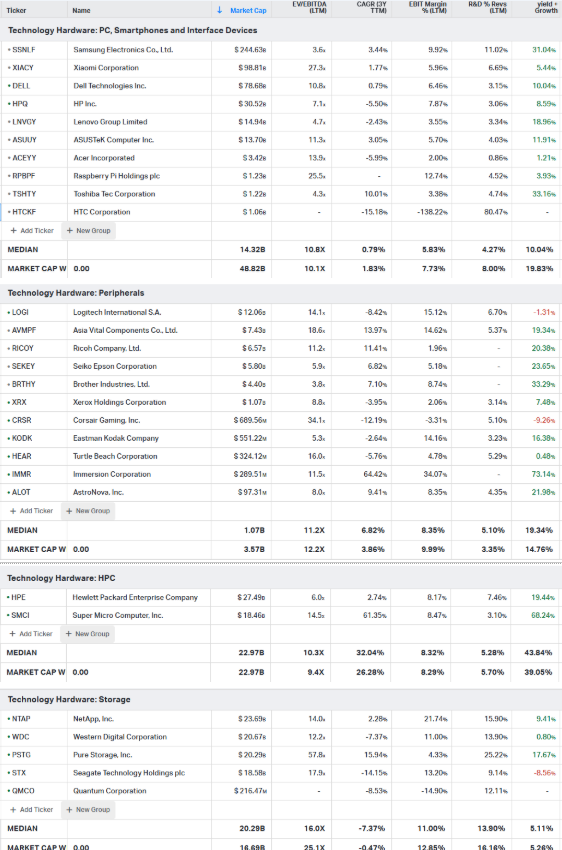

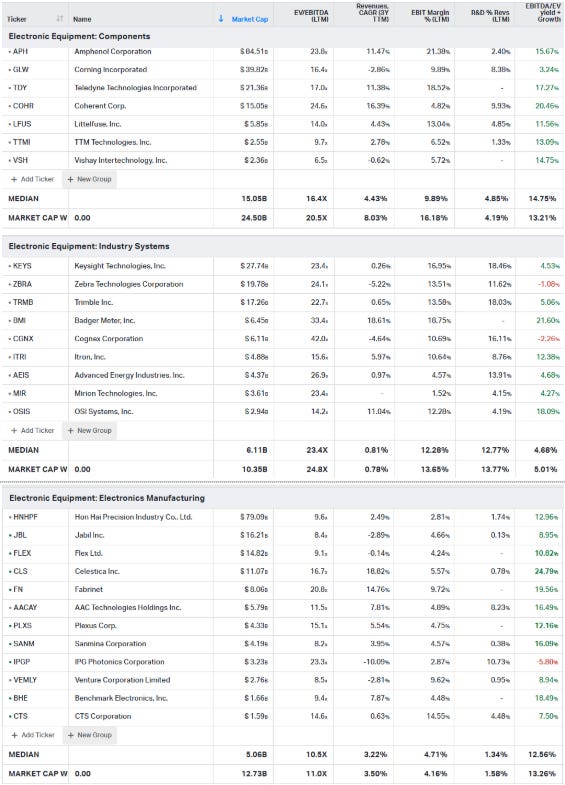

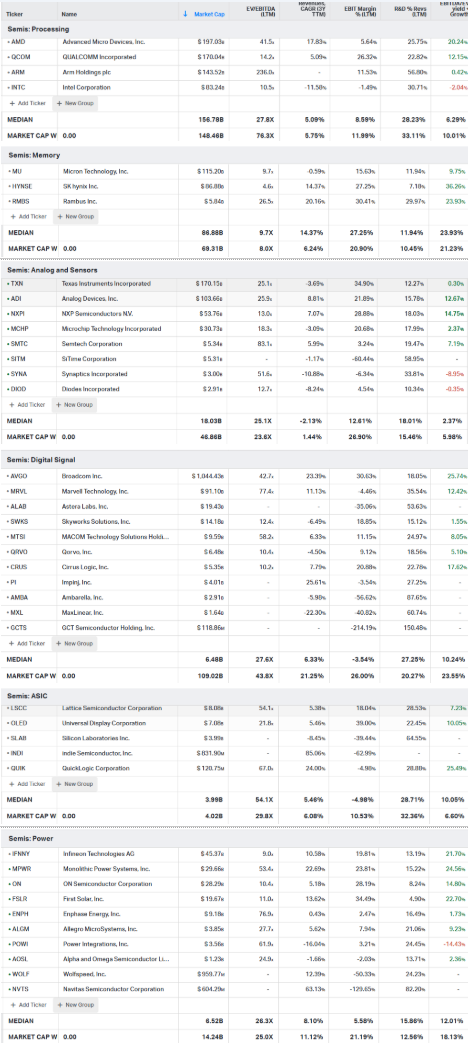

For each of the industries above, I have also classified individual companies into subindustries by product or service type. This information is found in the section below. In this section, however, I compile fundamental aggregate data (revenue growth, EBIT margins, R&D as a percentage of revenues) plus valuation data (mainly EV/EBITDA and the combined EBITDA + growth yield). The goal is to show an overview of fundamental and valuation metrics across the subindustries.

One interesting conclusion is that in many sub-industries, the sum of EBITDA yield and growth is very close to 15% plus or minus 2%. This is a mid-point of what the market considers fair. This valuation metric equates growth to yield, though. Growth is more risky, but if durable, it is more valuable than the current yield (as growth creates future yield). On the other hand, industries with higher yields are closer to the present, and therefore, their returns are ‘safer,’ one might say. Industries with a higher yield (lower multiple) would be less exposed to multiple contraction as well.

Another conclusion is the heavy spending on R&D in most industries, which ranges from 15% to 30% and even 50% of revenues in some cases. This shows that technological competition is a sector imperative. Whether or not to add back a portion of R&D to EBIT margins (whether R&D is investment or current spending) depends on each company and industry.

Finally, in many cases, EBIT margins are really high compared to other sectors. Most industries have EBIT margins above 15%, even with high R&D investment. This indicates sub-industries with (currently) very attractive economics.

The best margins are in software and semis. This might change in the future if software matures and becomes more competitive and as the industry cycles for semiconductors.

Overview of the IT industries

Interactive media

Interactive media is an umbrella term but generally refers to consumer-focused products consumed via a PC or phone. A better term would be ‘Consumer apps’ today, or ‘Consumer websites’ during the PC paradigm.

Generally, these services are free for users, so on the usage side, they should not be very cyclical (except for the marketplaces for discretionary categories). However, media companies make money on advertising, which moves with the business cycle.

Competition may be higher or lower depending on the specific category. Barriers to entry are very low, but network effects can build a moat.

Going a little deeper into the categorization:

Social networks: places where people join to share content with others. These companies generally have a niche with low competition and good economics (if they reach critical mass). Cyclicality of usage is low (they are free to use), but because they derive income from advertising, they may suffer from the ad spend cycle.

Dating apps: the name is self-explanatory. Again, mass is critical, but I would argue they are more competitive (there are some niches, but they are not as clear) and more cycle-dependent because they generate revenues from people paying for premium subscriptions (a discretionary category).

Collab Info: these sites could be classified as social networks in that they are based on the content of users directed to other users. However, these networks are used to share ‘useful’ information, mainly reviews. They depend mostly on ad revenues (yelp!, Tripadvisor, NextDoor), so they move with the ad cycle.

Alphabet and Meta are in their separate category (Behemoths). Alphabet would fit in Collab Info (because of Google) and social networks (or streaming because of Youtube), while Meta would be squarely in social networks. I haven’t added them to those categories because of their size compared to the other players.

Marketplaces: These sites offer a market for a specific niche (cars, insurance, home services, digital photos, employee boards). In most cases, they make revenue from internal advertising (sell-side paying to get listed more prominently) or as a commission on transactions. Cyclicality is high, as most categories are highly discretionary, meaning both buyer willingness to buy and seller willingness to advertise move with the cycle. Competition is high in most of the niches because there are no niche-dominant players.

Online advertising: These businesses allow other internet media companies to run and service ads. They charge a commission or spread on the ads served on third-party websites. The business is highly competitive, cyclical, and therefore also operationally levered.

Publishers: Owners of many websites (kind of like a diversified interactive media). They make money from ad revenues.

B2B Software (missing smallcap, it’s like 100 companies)

Note: In the GICS classification, this industry is called Systems Software and Application Software. I do not make that distinction here, using the term B2B Software.

These companies offer complete software products to businesses in many areas: security, finance, design, product development, work collaboration, supply chain management, etc.

The industry is growing due to the digital transformation trend, and competition is not particularly fierce because most companies have a niche (via product or market segment). Because of the long contracts around B2B products, these companies do not suffer from high cyclicality. Their main risk is technological obsolescence.

Scale is necessary because competing in the B2B market requires a heavy overhead structure, with a lot of investment in R&D (for the technology race) and big sales teams needed to land clients (particularly if the companies serve the Enterprise segment). On the other hand, when a client is landed, the risk of losing it is not that high because of switching costs. Network effects may play some role in a few applications but are not as strong.

Digital transformation or ERPs: Software that consolidates most of the operational data in a company and, therefore, is the backbone of digital management. A few companies dominate this sector, with some competitors in specific industry niches (mid/vertical).

Assisted Design and Work: Software used by different professions as a tool to do their work, like Adobe for designers, CAD or Ansys for engineers, Unity for game developers, etc. Very niche in each of the categories, they do not compete with each other, and have high switching costs (cost to learn a new software piece and change work procedures) plus network effects (like the software taught at a professional school).

CRM and customer: Products used specifically for sales, marketing, and customer support functions. Some are highly integrated (Salesforce, Hubspot), while others serve only specific functions (RingCentral, Sprinklr).

Work Collab: Products for managing digital workers, doing project management, having web calls, etc. Does not seem to have many niches, with relatively similar products, also potentially leading to low(er) margins.

Finance: Products for managing the accounting and finance functions of a company.

HR: Products for managing the HR function.

CyberSec: A relatively crowded sector of software used to protect the digital assets and hardware of companies. Maybe because of the higher competition, margins are lower.

Internet Services & Infrastructure (IaaS)

These companies provide software products that allow other software companies to use certain IT infrastructures, such as databases, cloud services, or video streaming. They could be called infrastructure-as-a-service (IaaS) companies.

Generally, their products are software pieces embedded in other software products. IaaS is a relatively novel approach to building software products. It is part of the ongoing cloud paradigm transformation. Before, each tech company would probably write its own stack for managing services like authentication or CDN, or it would use a licensed framework or open-source library.

Because the cloud paradigm is still expanding, and as we will see, each company in this sub-industry is quite niche, the markets are still expanding, and there is little competition.

On the other hand, because they have not reached a critical scale, many of these companies are not profitable yet. In the tables below, you can see that R&D more than offsets the negative EBIT margins of these companies. An important question to answer is how much of that R&D expense line (along with SG&A for market-building) is investment (improving the product, gaining market) and how much is simply a cost of doing business.

In addition, these companies service from and at the same time compete with the hyperscalers. Most of their services are provided by Azure or AWS, only not so focused.

The main risk for companies in this sub-industry is technological obsolescence and replacement, so it is key to understand their competitive position to follow developer forums and trends on sites like BuiltWith or GitHub. Network effects among developers can be strong moats in this industry.

In terms of classification, the main categorization is by the type of product/service the software or infrastructure stack provides.

Cloud/CDN: Tools to manage different cloud services (for example, some from Azure, others from AWS), and serving content over the internet.

Data management: database management tools used to either manage a specific database or connect different databases and work with the combined data.

Specialty: Different tools used to send messages, authenticate users, generate audio, stream video, etc. Very niche.

Domain registration: Not necessarily software, but rather a service to allow mostly individuals and SMBs to register domains and create simple websites.

IT Consulting

They are the (mostly) masons and (less so) architects of enterprise IT. They help traditional economy companies buy, build, and manage IT.

In this position, they sometimes act as gatekeepers to the enterprise world for software and hardware companies, but this is not always the case. Sometimes, they just implement what the technologists in each company have already decided.

Generally, these companies specialize in managing up to hundreds of thousands of technical and mid-qualified employees, mainly in low-cost countries, particularly India. Despite the undifferentiated offering, the industry is not particularly commoditized, and these companies enjoy positive margins.

In terms of growth, IT consulting companies have benefited from each platform change (PC, mobile, cloud) because each requires a new stage of digital transformation.

One of the industry's main risks is the impact of LLMs and AI in the space. If AI agents can replace the mid-qualification jobs that these companies offer, they may lose their market, given that their competitive advantage is the ability to manage large labor forces globally. On the other hand, a bull view of the AI cycle for these companies is that traditional economy companies now need to implement even more IT capabilities and develop AI-based services, all of which would require even more work from the IT consulting companies.

Another negative trend is the movement from monolithic, heavily customized enterprise products (think SAP or Oracle) that needed extensive company-by-company implementation to niche and task-specific SaaS products that internal teams can customize.

These are not super cyclical companies, even though IT investment can fluctuate greatly among their client companies. This is because these companies tend to have lengthy contracts, which dampens the effect of cycles. This is particularly true for Systems Integration and Managed Services (see below).

Research & Benchmarks: companies that evaluate software and hardware products to assist CTOs and tech teams in deciding what to implement.

Strategy and Advisory: They work mostly with the C level to decide what tech capabilities are needed and sometimes manage the lower levels of the pyramid during implementation.

System Integration: The people doing the tech implementation, for example, moving from SAP to Oracle.

Managed Services: They work as an outsourced IT desk, providing internal customer service, troubleshooting, user onboarding, and other services.

IT Distributors

The IT distributors resell technology hardware (PCs, printers, servers) and software licenses to companies. They are the middlemen of the IT world. Their role in software was much more important during the PC+license era but is now being reduced in software because of the expansion of the SaaS and pay-per-use models. It is a competitive arena with low margins, similar to a retailer or wholesaler not designing its products.

This industry is sometimes considered a sub-industry of Electronic Equipment for some reason I don’t understand.

Technology Hardware

Technology hardware is the sub-layer of the infrastructure closest to users. It includes PCs, smartphones, all the peripherals attached (printers, keyboards, joysticks), and networking and storage equipment at the enterprise level.

Technology has not advanced so much in this industry (the PC, laptop, or keyboard has not really changed in the past 20 years), so products have become commoditized, and growth has stalled a little. Growth and the cycle in the industry are driven by consumer discretionary income and employment growth (as people need work devices). The only exception to this may be High Performance Computing (HPC) and Storage, both of which are more tied to the datacenter infrastructure buildup in course.

Apple is part of this industry (it would be involved in PCs, Smartphones, and Interface Devices) but was not included due to its size.

Communications Equipment

Communications Equipment companies make the products that build the network infrastructure of the world, forming the backbone of the internet and cellular networks.

This was the booming sector in the 1990s and 2000s, as the internet infrastructure was first built. Today, some of these companies are still very profitable but are growing at a much slower pace. The sector is more cyclical, given that demand depends on CAPEX investment, mostly from telecom players and large compute providers (like the cloud hyperscalers).

One of the biggest players, Huawei, is not listed below because it is a private company.

Electronic Equipment

The companies in the Electronic Equipment industry either make small components that are then used in other tech hardware (communication modules, packaged batteries, etc.) or build IT systems used in industry for specific purposes (for example, computer vision systems for industries like Cognex or RF technology for warehouse and logistics management like Zebra). This is a balkanized industry with profitable niche players, which sometimes do not even need the best technology.

Finally, another subsegment is the Electronics Manufacturers, a very commoditized sector that assembles and builds IT products. It is a low-cost-driven industry where labor costs are important. The best example is Hon Hai Precision DBA Foxconn, the Chino-Taiwanese assembler of iPhones (among hundreds of other IT products).

Semiconductors and semiconductor equipment

Semiconductors are the most basic layer of the IT industrial revolution and, therefore, have become ubiquitous.

It is probably the arena where the hardware rules are most prevalent. Technological dominance is paramount since this industry has lived in deflation since its start more than 70 years ago. Technologies quickly become commoditized if competitors know how to replicate them. The industry has high fixed costs and cyclical demand (added to cyclical supply for chip manufacturers). It is also highly balkanized, as leading companies need to hyper-specialize to maintain a technological edge.

Inside semiconductors, there are two subindustries: the designers of chips (called semiconductors) and the supply chain that builds the chips (called semiconductor equipment). Going one level deeper, we can distinguish the designers by the type of chip they make, and the manufacturers by the stage of production they participate in.

The designers can be separated by the type of chip they specialize in (with the largest companies spanning more than one category).

Processing and controllers: These chips occupy the central computation role in any digital system, from a watch to PCs, phones, and data centers. Some of the largest companies (including NVIDIA, which is not listed below because it would skew the distribution) are in this segment. In turn, each of the companies specializes in a subsegment of the market, with Intel and AMD focusing more on the higher computation applications (PCs, graphics, networking, data centers) and ARM and Qualcomm focused on low-power applications (mobile, IoT)

Memory chips do not perform computations. They specialize in storing and retrieving information. Because there are fewer niches, memory has suffered from commoditization even more than other categories, as there are fewer large companies.

Analog and sensors: These chips interact with the real world and translate that information to the digital world, measuring everything from how your mouse moves to the radar on a car or measuring strength for an industrial robot. The applications are extremely varied, and there are plenty of niches.

Digital signal: These chips help digital systems communicate with each other by transferring and processing signals that are already digital (versus analog for the above). These include networking chips in PCs and data centers, or WiFi, and 4G chips on phones. This segment has grown particularly strong after the smartphone revolution, as more devices are connected to networks.

ASICs: ASIC stands for application-specific integrated circuits, a wildcard name because everything is application-specific. More specifically, it designates chips applied for a very narrow purpose, which is not included in any other category. For example, the Bitcoin mining chips specialize in hash computing or the semiconductors that generate the light that forms LED TVs and screens.

Power: These semiconductors are used for their electricity-welding capabilities, not for IT per se. They convert DC to AC in solar panel installations and batteries or regulate the power an electric motor in an EV receives. This is arguably the newest large application of semiconductors.

The Semiconductor Equipment could also be separated by the category of chip they specialize in or the level of complexity of the chips they work with, but the most common categorization is by the stage of production in which they focus:

Foundries: These are the actual semiconductor factories that receive designs from the designers and create the chips. The remaining subsegments of Semis Equipment sell to the foundries.

Wafer: The wafers are something like the uncooked dough used to create semiconductors, a very processed product awaiting final termination. Companies in this segment either manufacture wafers themselves or manufacture the equipment that is used to manipulate wafers. One example is ASML, which is considered the ‘most important company in the world’ because it designs machines that ‘cut’ into the wafer to generate the nano-channels that make up the chips.

Testing: Quality is the name of the game in semiconductor manufacturing. Testing companies provide the equipment used to check that each minuscule component of a chip works as intended before it is shipped. For example, machines with hundreds of pins can connect to a chip’s I/O pins to test that all of them are working and performing correctly.

Packaging: When the wafer is finished, several dozen delicate chips need to be separated and packaged into an encasing for protection and heat dissipation. This is done using specialized equipment.

Cleanroom: The level of cleanliness needed in semiconductor manufacturing is six-sigma. For example, edge chip transistor size is measured in 3, 5, or 7 nanometers, and a single particle of dust can be thousands of nanometers big. The production facilities need equipment for the workers and the rooms to ensure that not even a spark of dust is present, for it could destroy thousands of transistors.

Materials: The same degree of purity is needed for the materials used in semiconductor manufacturing. Purity is measured to the millionth or billionth atom. In addition to silicon, many other metals and rare earths (rare earths are metals, you dumb!) are needed for semiconductor manufacturing.

Excellent primer. You put the wrong image for the IT consulting companies.